There were three certainties of top slicing relief but they no longer apply, says Les Cameron, head of Technical, Prudential

There have always been three certainties to top slicing relief for insurance bonds. It was the difference in higher rate tax between the full gain and the slices, higher rate taxpayers did not benefit and everyone worked it out the “short way”.

No more! Changes to the Insurance Policyholder Taxation Manual at the tail end of 2018, linked to the introduction of the Personal Savings Allowance, have seen top slicing as we know it changed for good. It can also bring the £5,000 band of starting rate for savings into play too.

The key change was to our first certainty and that impacts everything else.

It’s worth reminding ourselves how things used to work.

HMRC had a six step process to work out the relief.

Step one: Add the total gain onto the individual’s total income and calculate how much of this falls into the higher rate tax band.

If all of the gain falls in the basic rate band, or the higher band, then no top slicing relief is due and steps two to six are not needed.

Step two: Calculate the Step two liability which is simply the Step one amount of gain falling into the higher rate tax band x 20% (difference between higher and basic rate tax).

Step three: Calculate the ‘annual equivalent’ of the gain by dividing it by N (the slice).

Step four: Add the total ‘annual equivalent’ onto the individual’s total income. How much of this falls into the higher rate tax band?

Step five: Calculate the Step five liability which is a two step process. Firstly the Step four amount of ‘annual equivalent’ falling into the higher rate tax band x 20% (40%-20%), then multiply this amount of tax by N.

Step six: The amount of top slicing relief is the Step two liability less the Step five liability.

Not many people started that six step process as the short method (almost always) sufficed.

Broadly, the short method meant you calculated your slice:

- If it fell wholly in the basic rate tax band then full top slicing relief was due and there would be no higher rate liability.

- Where it fell wholly in the higher rate band no top slicing relief was due.

- If the slice crossed the higher rate threshold you would identify the proportion of the slice in the higher rate band and it was only that proportion of the total gain that would suffer a higher rate liability.

Similar principles applied at the higher/ additional threshold.

But now the short method will not work and higher rate taxpayers may get top slicing relief. It appears that the old 6 step process we all knew and loved was not entirely consistent with the law and we now have a five step process.

Change to certainty – the new 5 step process

The fundamental change to our first certainty is that top slicing relief is based on the difference in total tax on the full gain and the slices instead of just the amounts in the higher rate tax band.

HMRCs new five step process is as follows:

Step 1: Calculate the total taxable income for the year and identify how much of the gain falls within the starting rate for savings, personal savings allowance nil rate, basic, higher or additional rate bands as appropriate.

Step 2: Calculate the total tax due on the gain across all tax bands. Deduct basic rate tax treated as paid to find the individual’s liability for the tax year.

Step 3: Calculate the annual equivalent of the gain. The annual equivalent is calculated by dividing the gain by N.

Step 4: Calculate the individual’s liability to tax on the annual equivalent. The amount of the savings starting rate and personal savings allowance used in the top slicing relief calculation are set by virtue of the taxpayer’s adjusted net income for the tax year. They are not adjusted to calculate the notional tax due on the ‘sliced gain’. Deduct basic rate tax treated as paid* on the annual equivalent and multiply the result by N. This gives the individual’s relieved liability.

Step 5: Deduct the individual’s relieved liability at step 4 from the individual’s liability at step 2 to give the amount of top slicing relief due.

The process is identical for onshore and offshore bond gains.

What the change has done is ensure taxpayers benefit from any available personal savings allowance and to a lesser degree, starting rate for savings. Interestingly, the new method effectively gives the benefit of multiple personal savings allowances and, albeit less likely, starting rate for savings when determining the amount of top slicing relief.

An example

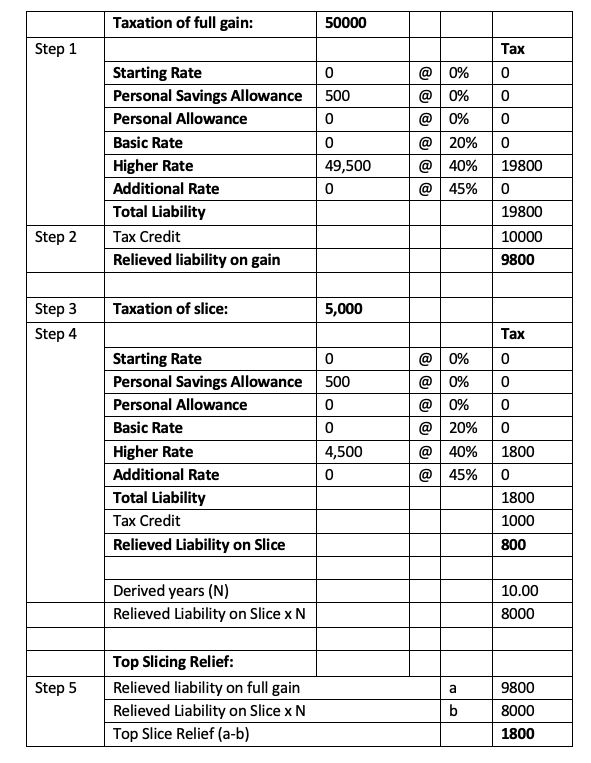

A quick example using 2019/20 tax bands (the £50,000 threshold is so much easier for doing sums!).

Bob has a salary of £50,000 and a £50,000 onshore bond gain over 10 years.

Under the 6 step method no top slicing relief would be due, “If all of the gain falls in the basic rate band, or the higher band, then no top slicing relief is due and steps two to six are not needed.”

Under the new 5 step process it’s a bit different

The new 5 step process has resulted in top slicing relief going from £0 to £1,800 – quite a change. As the full tax free amounts are available for every slice the higher “N” is the higher the benefit will be.

Since the introduction of the personal savings allowance there has been much confusion of how it would interact with the top slicing rules.

Now we know!