Dave Downie, technical manager, abrdn, highlights the risks clients have of tax drag when keeping money in cash.

With interest rates still relatively high compared to historical standards, it’s understandable that some savers may be tempted by the potential of a relatively ‘risk-free’ return of around 5%.

But – as all advisers and paraplanners know – while cash deposits are not directly at risk of market fluctuations, there are still some other risks savers need to be aware of for holding money in this asset class.

There’s the obvious danger that, by being in cash and out of the markets, they’ll potentially miss out on the bounce when markets rebound.

But there’s a further, often overlooked, impact of being in cash rather than equities – the tax drag.

Comparing rates and allowances

To understand tax drag we need to remind ourselves of some of the differences between cash deposits and equity investments in a few key areas:

Rates

Cash deposits simply pay interest which is subject to income tax at either 20%, 40% or 45% as it arises.

An equity-based unit trust or OEIC, that’s a fund with less than 60% invested in cash of fixed securities, will pay dividends which are taxed at either 8.75%, 33.75% or 39.35%. Unlike cash deposits they will also be subject to capital gains tax on their capital growth at either 10% or 20%.

Allowances

The personal allowance is available to both interest and dividend income. But there are other allowances which are specific to the type of income received.

There’s no tax on interest from cash deposits if it can be covered by the Personal Savings Allowance (PSA). For basic rate taxpayers, this exempts £1,000 of interest from tax, falling to £500 for higher rate taxpayers. There’s no PSA available to additional rate taxpayers.

For equity funds there are allowances available for both dividends and capital gains. The dividend allowance is £1,000 (2023/24) and the full £1,000 is available to everyone regardless of their level of income. However, this is set to fall to £500 a year from April 2024.

There is also an annual exemption for capital gains. There’s no tax payable first £6,000 (2023/24) of capital gains. Like the dividend allowance this is also set to be halved to £3,000 from April.

Tax drag: the impact of tax on investment returns

It’s clear from the above that both the tax rates and allowances are more favourable for equity funds than cash deposits. Consequently, there is greater ‘tax drag’ – the impact of tax on investment returns – on cash deposits.

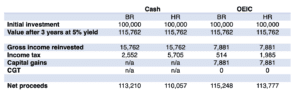

To examine the impact of tax drag in more detail, let’s look at some practical examples – comparing £100,000 invested in a cash deposit earning 5% interest, with same £100,000 invested in an equity OEIC achieving the same 5% return split 2.5% dividends and 2.5% capital growth.

The table below shows the amounts both a basic (BR) and higher rate (HR) investor may get back once tax has been deducted after three years:

Note, in calculating this example, we’ve made the following assumptions:

- The investment was made on the 6 April 2023

- Gross amounts are reinvested, and any tax liabilities are paid separately.

- Capital gains are crystalised each year and the full CGT exemption is available.

- The full personal savings and dividend allowances are available.

- The full personal allowance is available and has been fully used by other income.

- The dividend allowance and CGT exemption are halved from 6 April 2024.

- All gains and income taxed fully at either basic or higher rate.

This demonstrates how the lower tax rates applicable to dividends and capital gains within the OEIC result in more spendable capital.

The above results rely on capital gains in the OEIC being crystalised each year. With the drastic reduction to the annual exemption this may no longer be possible or practical.

But even if this type of planning is not undertaken the tax drag on the cash deposit will still be higher thanks to the higher rate of income tax on the interest.

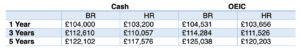

Let’s look at a second table, considering the same investment amount and returns but this time assuming that the capital gains annual allowance, dividend allowance and personal savings allowance have already been used elsewhere.

This highlights the net returns, ignoring all allowances over three different time periods:

Note that, again, we’re making some assumptions in this example, namely:

- Gross amounts are reinvested, and any tax liabilities are paid separately.

- The personal allowance has been fully used by other income.

- All gains and income taxed fully at either basic or higher rate.

Insight to action

Many savers will want to hold some savings in cash for liquidity reasons as a possible rainy day fund.

But where an active decision is being made to move long-term savings to cash to capitalise on relatively high interest rates, it’s important not to overlook the effect of tax drag on those returns.