Carry forward – future planning

People who are not currently members of UK registered pension scheme are depriving themselves of the potential to use carry forward in the future.

Case study

John is the sole director of his company. He has no pension provision at all and doesn’t expect to be in a position to make significant contributions until 2022/23.

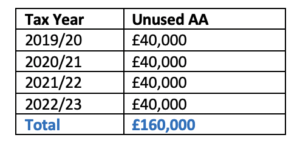

On the assumption the standard AA remains at £40,000 and John’s income doesn’t result in his AA being tapered then his unused AA position in 2022/23 would be as follows:

Although John has unused AA of £120,000 from the three tax years prior to 2022/23 he was not a member of a registered pension scheme in those years so he can’t carry forward the unused AA. So although his accountant may be saying a company contribution of £100,000 will attract corporation tax relief, John only has the 2022/23 AA of £40,000 available. If the contribution was made it would create an AA excess of £60,000 and John (not the company) would incur an AA charge on the excess taxed at his marginal rate.

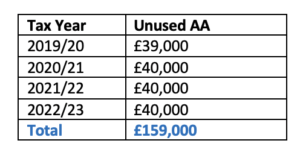

If John makes a small contribution of say £1,000 in 2019/20 then his unused AA position in 2022/23, based on the same assumptions above, would be as follows:

By making a contribution in 2019/20 John would be classed as a pension member in the three tax years prior to 2022/23. This increases his AA by £119,000 providing John with sufficient AA to cover a PIA of £100,000, leaving some unused from 2020/21 and 2021/22 to maybe use in future years.

For any clients you have that don’t have pension provision a small contribution this tax year could have a significant impact on future pension planning.

Money Purchase Annual Allowance & Tapered Annual Allowance

It’s not uncommon for clients to flexibly access their pension (and in doing so trigger the MPAA) without notifying their financial adviser. Triggering the MPAA could have a significant impact on the pension planning that was discussed in the previous tax year. The client may also be unaware of the rules for notifying other money purchases schemes about triggering the MPAA and the penalties that apply if the deadline is not met so this may need to be addressed.

The client may have received a pay rise, bonus or stared new job on a higher salary since your last meeting. If the client was already subject to a tapered AA in the last tax year this will mean revisiting last years tapered AA calculations or the change may now require tapered AA calculations. Carry forward calculations may also need to be reviewed.

Page: 1 2