Defined benefit transfers fell to their lowest level in March as the COVID-19 crisis sent shockwaves through the financial markets.

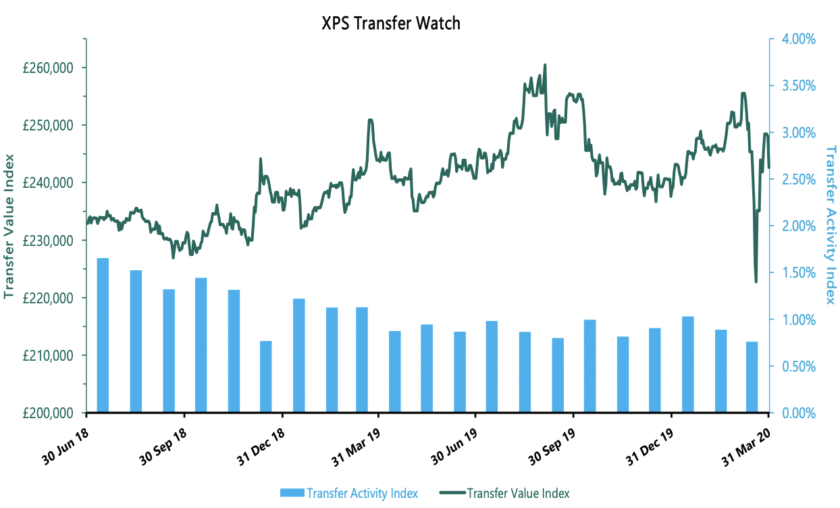

The number of DB transfers completed in March dropped to an equivalent of 0.76% eligible members, down from 0.89% in February, according to XPS Pensions Group’s Transfer Value Index.

The pensions consultancy said that while the March figure wasn’t far off average levels recorded over the past year, it marked the lowest figure since the index began in 2018, reflecting a desire among savers to shy away from making big decisions in the current climate.

Meanwhile, DB transfer values fell by 3% last month, from £249,700 at the end of February to £242,600 at the end of March. However, XPS said there were sharp fluctuations throughout the course of the month, with values dropping by as much as 11% to £222,800 at one point – a level not seen since July 2016.

Mark Barlow, partner, XPS Pensions Group, said: “The unprecedented COVID-19 crisis has sent shockwaves through the financial markets, causing the greatest fluctuations we have ever seen in the Transfer Value Index.

“With such volatile markets, it is perhaps unsurprising that transfer activity has also fallen, to the lowest level since the inception of the Index, as members shy away from big financial decisions in the current climate.”

At the end of March, the Pensions Regulator also issued guidance in relation to transfer values, as part of its wider COVID-19 guidance. It confirmed that it would not use its regulatory powers for a period of three months where trustees suspend transfer values and as a result, breach transfer value disclosure requirements.

Barlow added: “We welcome the Regulator’s guidance on transfers as it provides comfort to those trustees looking to pause and take stock. However, we have found that around 75% of our clients are still able to continue quoting and paying DB pension transfers. In these cases, member support services such as scam protection and high quality financial advice, will be crucial in protecting member outcomes in the current environment.”