As the debate around the cost of social care continues to rage on, property looks likely to make up a significant proportion of how people will fund their care, but the extent it will pay for varies significantly across the country, new research has shown.

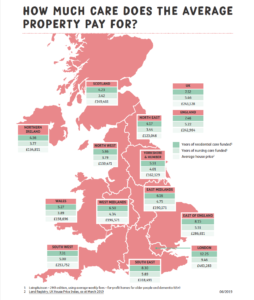

With property prices varying hugely and the cost of residential care also differing from county to county (see map below), pensioners face a substantial difference in the number of years of care their property will pay for, according to Just Group’s 2019 Care Report4.

The average house price in the North East is £123,046 – substantially lower than in London, where the average house is priced at £463,283.

Similarly, the cost of residential care is also affected by the north / south divide, with average weekly charges of £523 in the North West versus £738 in the South East. Nursing costs vary even more, with treatment in the North East averaging £688 a week compared to £1,039 in the South East and £1,001 in London.

Just Group’s research revealed that Londoners could find their average-priced property wealth all used up to pay for care within a 12-year period, while those in the North East may only be able to fund four years of care before they become fully dependent on what the government can offer.

The research found that despite the number of 85s expected to more than double to 3.2 million by 2041, just 8% of those aged over 65 are making specific saving plans for meeting care costs, leaving the money to be found elsewhere.

Stephen Lowe, group communications director, Just Group (pictured), said: “Most working people prioritise buying a house and it is often their most valuable asset. Under current rules, that value has a crucial role in helping people afford care they might need in the future. Our research shows how radically different the picture of paying for care through housing wealth is across the country with no obvious winner.

Lowe added: “It provides peace of mind to put in place your own plans. That will mean talking with friends and family about what you would like to happen. These conversations should help with working out how to meet the cost whilst still retaining some financial control.”