In volatile markets it is important to maintain investment discipline and find portfolios that offer resilience. This is where multi-asset portfolios can help, says Andreas Zingg, head of Multi-Asset Solutions, Europe, Vanguard.

UK financial assets have fallen sharply since the government announced its “mini-budget”, which included substantial tax breaks for households and businesses that spooked the financial markets. The value of the pound fell to record lows against the dollar and UK government bonds also fell sharply, pushing up yields and forcing the Bank of England to take emergency action to help restore confidence in the country’s financial system.

The volatility has come amid an already challenging year for multi-asset investors. Global bonds continued their record declines in the third quarter of 2022, falling nearly 15% since January. Global equities also posted their third consecutive quarter of declines, down nearly 10% since the start of the year.

For investors, maintaining disciple at times like this can be extremely challenging but often proves the best course of action over the long-term. More often than not, short-term tactical shifts in asset allocation, whilst comforting to investors, lead to portfolio imbalances that can ultimately impact investment outcomes.

What does this mean for the role of bonds in multi-asset portfolios?

Much of the focus this year has been on the underperformance of bonds. The simultaneous sell-off in both global equity and bond markets in 2022 has led some investors to question the diversification benefits of multi-asset investing. However, it is important to remember that the primary role of bonds in a well-balanced portfolio is as a ballast to equities, not as a driver of returns. Despite recent declines, bonds still remain the best asset class to act as a counterweight for equities over longer periods of time.

History shows that simultaneous declines in stocks and bonds are not that unusual over relatively short time periods. When we look at performance over longer time frames, however, the diversification benefits of multi-asset investing are clear: balanced portfolios consistently provide strong outcomes for long-term investors who stay the course.

Multi-asset portfolios offer resilience

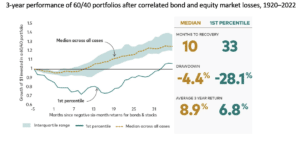

3-year performance of 60/40 portfolios after correlated bond and equity market losses, 1920–2022

Past performance is not a reliable indicator of future results.

Source: Vanguard calculations, based on data from Robert Shiller’s website, for the period 1920-2022.

Notes: Stocks: S&P500 returns, Bonds: 10-year US Treasury returns based on linear duration approximation. Returns calculated in USD with income reinvested. ‘Recovery’ defined as time taken for portfolios values to reach initial investment value ($1).

Investors can also have confidence that their multi-asset portfolios will recover over time. The chart (top above) shows the historical returns of 60/40 portfolios after periods when equities and bonds simultaneously declined over the last 100 years. On average, the portfolios (shown by the yellow line), recovered their initial losses after ten months and provided an average annualised return of about 10% over the subsequent three years. Even when we look at the worst-performing 60/40 portfolios, where the decline was over 28%, it took them around 2.5 years to recoup their losses, after which they provided an average annualised return of nearly 7%.

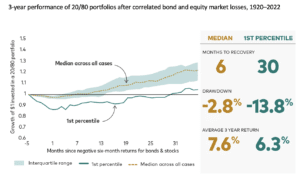

This ‘all-weather’ resilience is not just limited to 60/40 portfolios and applies across the risk spectrum, according to Vanguard research. The same analysis of 20/80 portfolios found they took an average of six months to recover their initial losses, after which they provided average annualised returns of 7.6% for the next three years. This is largely because investors who stay the course after periods of low or negative returns benefit from being fully invested right when valuations are at their most attractive, leading to strong total returns when market conditions change.

Additionally, bonds have historically provided a buffer against recessionary sell-offs that often occur across riskier assets during periods of slowing economic growth. Investors who shift away from bonds now could end up locking in their losses while potentially dismantling their ability to fully participate in the benefits of their bond holdings when market conditions change.

[Main image: alex-shute-4lA1sDFr8Y8-unsplash]