The advice industry still has a long way to go to maximise the opportunities offered by technology, according to a new report from NextWealth.

NextWealth’s Adviser Tech Stack Adviser Review found that over 80% of advisers use a practice management/ back office system, risk profiling tool and cash flow modelling tool, while just over 70% use a client portal.

Yet the majority of advisers lack the skills to efficiently navigate the tech marketplace and the technology they do use is significantly under-utilised, the report found, with the majority of tech solutions needing to be configured and mapped to existing workflows before any business benefits are realised.

Heather Hopkins, managing director of NextWealth, said: “Every stage of financial planning has been shifting from manual processing to tech enabled practices and new tools and technology are constantly coming to market that promise to deliver greater efficiency and more effective insights.

“The issue is that much of this new tech requires the users to be tech literate and most advisers are not. For some, this will be solved by employing specialist IT support. For others, they will adopt a single source approach to technology.

“Tech providers also need to better understand the issues and to focus on developing systems that are intuitive and easy to use. Until this happens, the tipping point for fully integrated, tech-enabled advice that makes the most of humans and robots will remain a dream not a reality.”

According to the report, a lack of time poses the biggest barrier to adopting new tech among advisers.

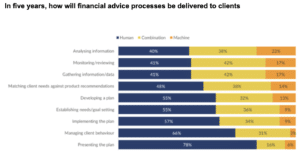

Looking ahead, advisers still expect most aspects of financial planning to be delivered by a human in five years’ time. Two thirds (66%) believe managing client behaviour will be carried out by humans and 31% expect a combination of humane and machine, while just 3% believe it will be machine-generated.

In addition, over half (55%) of advisers also expect humans to be responsible for establishing client needs and goal setting, compared to 36% who believe it will be a combination of human and tech and 9% who expect it to be machine-led.

The integration of technology was considered most important among bigger firms, in part because they are better set up to roll out tech and provide training.

A fully integrated risk profiler, cash flow modelling and investment mapping tool which offers seamless client reporting was the most popular proposition, with 73% of advisers ‘very or somewhat interested’, while 69% were interested in a tool to integrate withdrawal strategy with portfolio management so client income requirements are systematically met by model portfolio.

Hopkins said: “Adoption of new technology is a challenge. Advice tech providers tell us that less than a quarter of the functionality available is used. Advisers tell us that a lack of time to learn to use technology effectively is one of the biggest barriers to adoption. Too often we hear that adviser tech solutions, back-office systems in particular, are cumbersome and difficult to navigate. Tech must be user friendly to be adopted and training and support must be top-notch.”

“Customers want financial security throughout their lives and most also want to gift some of their wealth at death. Customers want to speak with a human when they need some reassurance. They want to feel understood and looked after. Advisers should make good use of tech so that customers can access information when they want. Customers should be able to self-serve when they want and get help from a trusted professional when they want.

“The technology an adviser uses should be best in breed and it should connect seamlessly with other systems and tools. The adviser should be recognised as a trusted agent of his or her clients, able to access data and act on behalf of that client.”

Hopkins says that while the tech “tipping point” is still a few years away, there are several factors driving its adoption including growing customer expectations; investment in financial advice businesses; and the fight for talent.