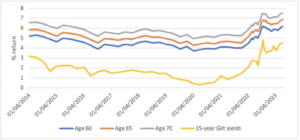

Many over-50s do not consider annuities to offer a good rate of return, despite the significant improvement in rates over the past 18 months, says Canada Life.

Research by the group found that only 14% of over-50s who are familiar with annuities consider them to currently offer a good rate and just 3% consider them to offer a very good rate. In contrast, those aged over 50 are more likely to say that annuities currently offer a poor rate of return compared to the long-term trend than they are to say that they offer a good rate of return.

More than half (53%) of 50 + year olds say that an annuity rate of above 4% is ‘good.’ However, 26% will only consider rates ‘good’ once they reach above 7%.

Current rates mean that a benchmark annuity for someone aged 65, with no pre-existing health or lifestyle conditions, would pay in the region of 7%. This rate could increase for those health conditions such as diabetes or high blood pressure.

Nick Flynn, retirement income director at Canada Life, said: “Annuities have been on a roll with rates increasing significantly over the past 18-months, at one point up by nearly 50%. This is a remarkable shift in fortune in a very short space of time for annuity rates and therefore they need more than a cursory glance when choosing your path to deliver your retirement income.

“Our data shows that consumers have not yet caught up with the rapid rate improvements. Do your research, consult a qualified financial adviser or experienced annuity broker, and consider all your options, it doesn’t have to be an either-or approach to retirement income. Often, a blend of drawdown and annuity can provide a better retirement solution. Although annuities are the only game in town that can deliver 100% security and peace of mind of a guaranteed lifetime income.”

How lifetime annuity rates have changed over time

Source: Canada Life annuity rates over time, as at 01/07/2023