Funds employing a value-oriented investment style have demonstrated superior performance compared to their growth-focused counterparts in the recent rebalance conducted by FE fundinfo.

The latest Crowns rebalance by the research company, revealed a noteworthy outperformance of value style funds across all equity markets. This contrasts significantly with growth-oriented funds, particularly those concentrated in technology investments, which exhibited comparatively weaker results, the firm said.

Funding pointed out that value and cyclical managers have performed better because their portfolios are often composed of companies that thrive during periods of economic expansion. The managers strategically invest in undervalued assets and industries poised for growth, leveraging the global economy’s resilience to enhance their performance.

In contrast, defensive growth-oriented managers, who typically invest in companies with consistent earnings regardless of economic conditions, typically underperform when economic conditions are better than expected. As a result, the resilience of the global economy plays a pivotal role in the outperformance of value and cyclical managers over their growth-focused peers.

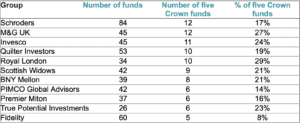

Overall, 19 funds gained FE Fundinfo’s 5-Crown rating during this latest rebalance, bringing the total number of 5-Crown rated funds to 361. To qualify for the highest rating, funds must be in the top 10% of ‘Crown Scores’, which are calculated in three parts, each referenced to a benchmark. Funds must also have a three-year history to qualify.

Commenting on the latest crown ratings data, Charles Younes, Deputy Chief Investment Officer, FE Investments, said: “Contrary to expectations one year ago, 2023 unfolded as a seamless extension of 2022, with inflation and central bank decisions emerging as pivotal influencers in financial markets.

“While the trajectory of equity and bond markets shifted from negative to positive, the prevailing victors remained consistent – strategic bond managers, displaying adeptness in adjusting their interest rate sensitivity, and equity managers focused on value and cyclical assets.

“Consequently, it comes as no surprise that our Crown ratings witnessed minimal alterations. While January 2023 marked a pivotal shift in leadership, January 2024 signals a continuation of the same trend.”