Alan Dobbie Rathbone Income Fund, co-manager,

UK dividends have recovered strongly over the past couple of years, yet few people have seemed to notice. Payouts from FTSE All-Share companies are now just 8% shy of 2019’s record level after rising 17% in 2021 and likely a further 23% in 2022. This is a much swifter recovery than many had predicted in the heat of the pandemic. Three key sectors have done the heavy lifting.

Digging out dividends

Historically, miners haven’t been a happy hunting ground for reliable income. Despite operating in a notoriously cyclical industry, too often mining executives haven’t heeded past lessons, frequently getting caught up in the excitement of a cyclical upswing and overpaying for mines (or worse, prospects) close to the peak in commodity prices. Not so now.

Big miners showed admirable restraint over recent years, ensuring that income investors, rather than investment bankers, benefited from this commodity cycle. The result? The sector accounted for more than 15% of UK dividends in both 2021 and 2022, double its 10-year average.

Rebase and rebound

In 2020 BP and Shell slashed their dividends by 50% and 66% respectively. In truth this had been some time coming, as both companies had for years borrowed to pay out dividends much higher than profits. COVID-19 gave them the chance to reset payouts at more sustainable levels.

From their new base, buoyed by rising oil and gas prices, energy sector dividends have soared. Shell announced a 15% increase in its Q4 2022 dividend, alongside $4 billion of share buybacks. This was its fifth meaningful dividend increase since the 2020 rebase and leaves the quarterly dividend 80% higher than that paid at the pandemic’s nadir.

While the sector may not be the income powerhouse it once was, with more capital being diverted towards the energy transition, dividends could become more sustainable and with greater growth potential than in the pre-pandemic years.

Returning to the (dividend) register

Finally, UK banks were the surprise income stars of the past two years. After the regulator banned them from paying dividends in 2020 to preserve their ability to deal with widespread defaults, the high street names returned to the dividend register with aplomb. Profits swelled due to rising interest rates, leading many banks to opt for a steadily growing ordinary dividend, topped up by specials or share buybacks. In 2022, NatWest – a bank not known for financial prudence under its previous RBS moniker – was forced into a large special distribution by dint of its embarrassingly large capital position. As with miners and energy giants we believe lenders have learnt the lessons of history to the benefit of UK income investors.

While it’s great to talk about a much healthier environment for dividends, we’re more concerned about the future than the past. Therefore, it’s important to recognise three potentially sizeable headwinds facing UK payouts in 2023.

How to spend it

Historically, UK companies chose to return cash to shareholders primarily via dividends. However, more recently, share buybacks have become increasingly important for companies flush with cash. The dividend gurus at Link Group note that a record £50bn, or 2% of UK market capitalisation, was spent on share buybacks in 2022. Whether this was down to savvy management teams taking advantage of low share prices, US corporate culture seeping across the Atlantic or changes in dividend taxation is up for debate. Whatever the reason, if this trend continues in 2023 dividends could be pressured from more cash being siphoned towards share repurchases.

Sterling swings

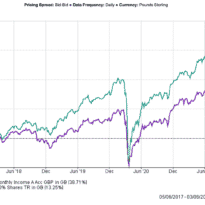

With roughly 80% of its revenues generated overseas, the multinational nature of the UK market is well-known. While this provides a great source of diversification versus more domestically oriented indices it also leads to greater volatility in the sterling value of UK dividends. In 2022 British dividends were boosted by sterling’s stumble following the mini-budget debacle. More recently, sterling strength, on the back of greater political stability, has worked against UK payouts. If this continues it could be a stiff headwind for UK dividend growth in 2023.

Beyond the red flags

It takes a brave board to declare a bumper payout heading into a well-flagged recession. With few economists expecting the UK to avoid a downturn this year, no board wants to reward shareholders one year only to ask for the cash back further down the line.

But what if the recession is not as deep as feared? With balance sheets so strong, boards may well loosen the purse strings as the year progresses, turning the tap on just a little bit for both investment and for dividends. Investors in the UK have been rewarded for their patience over the last two years, yet hardly anyone has noticed. Twenty Twenty-Three, despite downbeat predictions, could be another good year for UK income investors.

[Main image: ristina-flour-BcjdbyKWquw-unsplash]