We asked the M&G Wealth technical team to respond to a specific question raised by a paraplanner. Here is the answer, will which also appear on the M&G Wealth website Insights Library.

Q: Is the Rysaffe principle actually used that often, or just one of those ideal things that could be done that are not that practical for the majority.

A: “Rysaffe planning” involves setting up multiple discretionary trusts on different, often consecutive, days to obtain multiple Nil Rate Bands (NRBs) for periodic charge purposes.

In the past, several pilot trusts (perhaps each only holding £10) were set up in the expectation that large sums of money would later be added to the pilot trust, commonly post death. However, this planning largely came to an end when the government introduced the “same day addition” rules in Finance (No.2) Act 2015. Broadly, this meant that any trusts that received money on the same date were treated as one for the purposes of IHT.

Rysaffe planning with pilot trusts was considered under General Anti Avoidance Rules guidance as being non abusive as it was it was accepted practice – HMRC did not update the rules and guidance after losing the Rysaffe case.

The same day addition rules essentially ended the multiple pilot trust approach. There has been no guidance or commentary since on the use of multiple non pilot trusts and this planning is still carried out. There are three main areas.

Firstly, with large single premium investment bonds being used in conjunction with trusts for IHT planning. “Rysaffe” can indeed be practical although extra paperwork will be necessary.

Planning is restricted here as entry charges can be a limiting factor for (say) simple discretionary gift trust planning. Only £325,000 can be settled in trust in any 7 year period without lifetime charges to IHT arising.

Consider client A who has made no previous gifts but now wishes to gift £325,000 on discretionary trust.

If they settled one trust, they would have one NRB available at the 10th anniversary. Assuming the money doubled the £325,000 growth would be subject to a periodic charge at 6% (£19,500).

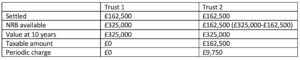

However had they settled 2 trusts, on different dates to avoid the same day addition rules, Rysaffe would create IHT savings.

The IHT charge has halved by creating an extra amount of NRB with the second trust.

We also see Rysaffe planning with large loan trusts. This is a type of trust established with a loan to trustees as opposed to a gift. All the growth in the invested amount is outside the estate however the settlor can recall (or waive) the loan at any time.

Consider another client (who also has carried out no prior IHT planning) who has £1m to invest and is considering setting up a discretionary loan trust. The growth will accrue within the confines of a discretionary trust and if only one trust is established the trustees will have a £325,000 Nil Rate Band for periodic charge purposes because there have been no earlier chargeable transfers. Again if the fund doubles in 10 years there will be £675,000 taxable at 6% giving a periodic charge of £40,500. Now instead, assume the client sets up four discretionary loan trusts on different days for £250,000 each. When the second and subsequent loan trusts are set up the previous ones do not use up any NRB as there is no gifting to establish a loan trust. The result? Each loan trust has a NRB of £325,000 to shelter the growth from periodic charging. As the growth on each trust would be £250,000 then there would be no periodic charge at all – a saving of £40,500.

The planner needs to be careful when adding to trusts by way of further gift or waiving of loans that these do not happen on the same day so triggering the same day addition rules, undoing all your Rysaffe planning! If the trust deed has a tick box option for the outstanding loan to be cancelled on death of the settlor, then don’t tick the box if Rysaffe planning is being undertaken.

Lastly, Rysaffe planning can also apply to significant regular premium whole of life policies. The trust value will comprise the higher of total premiums paid at the 10th anniversary or the open market value (OMV). The planning outcome desired is to keep each trust value below the NRB.

Say the client has secured a £1m sum assured and this will cost £40,000 per annum. The plan is to have the policy under a discretionary gift trust. Assuming they are in good health at the 10th anniversary the value for IHT is £400,000 giving a periodic charge of £4,500[(£400,000 – £325,000) x 6%]. Splitting the policy into two with two trusts would mean no periodic charge as both trusts would have full NRBs and the sum of premiums paid would only be £200,000.

The number of trusts will depend on the expected life span of the assured and whether the sum assured was likely to be held in the trust at a 10th anniversary or not. If the £1m sum assured was expected to be in trust at a 10th anniversary then four trusts might be considered. Likewise if premiums would be paid for 20 years, i.e. the second 10th anniversary, then the £800,000 premiums would require at least three trusts to keep the sum below £325,000. Note that term policies are not subject to the ‘total premiums paid’ test but are subject to the OMV test. The consideration for the planner is therefore based on sum assured and the likelihood of that being held at a 10th anniversary.

Rysaffe is not as useful as it once was but it still has its uses when it comes to reducing the trustees IHT bills. How often it is used? I don’t know. But it could be used in the right circumstances if your goal is less IHT.