Dan Atkinson, head of Technical at EQInvestors considers retirement planning and asks: Do we really know what our clients want?

First published in the October issue of Professional Paraplanner

As paraplanners, one of the things we get involved in for our clients is retirement planning. Practically this involves looking at pensions, investments and how we can organise cashflows to meet spending requirements. Our focus is on making sure that the money is likely to last and that tax is sensibly planned for.

Something I’ve been thinking about recently at EQ Investors is what Retirement Planning really means for clients. If we set down our spreadsheets and cashflow models for a moment, what is it actually about? What do people need to know about retirement so that they can plan for it? Whilst we may be slightly removed from these questions, I think it is important that we, as paraplanners, develop some understanding so that we can be empathetic in our approach.

So how can we do this? There may be some reading this who are approaching their own retirement, but for many of us this is several decades away. Drawing on our own experiences will be limited and subject to bias as our family circumstances may differ to our clients. Thankfully, there is a growing body of research (and even better – people summarising the lessons from it!) in the public domain we can draw on.

One paper I’d encourage you to download and read is the Pensions Policy Institute’s Living Through Later Life report. You’ll gain insights about how the different phases of independence change what people can do and feel they can do. We should be talking about this as clients map out what they want to achieve. Sharing what we learn from this type of research can help our clients make informed decisions about how to get the most out of retirement.

Comma not a full stop

Traditionally people have thought of retirement as a full stop, but this report shows that this is less of a case. In 2018 half of those reaching State Pension Age were considering continuing to work. Those who are ‘tired’ of working still seem to step straight into full retirement, but others are finding a transition more helpful. What are your clients planning? Depending on their role they may find opportunities for sharing their skills on a voluntary basis or supporting other businesses in a non-executive director capacity.

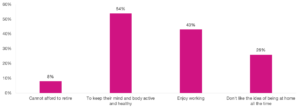

I think we might fall into the trap of thinking that people keep working because they can’t afford not to. The chart below looks at the reasons identified with by people who reached State Pension Age in 2018 and were planning to continue working. Even when the researchers looked at all the people remaining in work after State Pension Age they saw that the majority did so by choice rather than necessity.

Reasons for continuing to work beyond SPA among those scheduled to retire in 2018

Source: Pensions Policy Institute

Now, these people weren’t always doing the same job or indeed working at the same company. Look at the reasons highlighted in the chart. The key lesson is that people keep working to keep active. Some research has also linked keeping your mind active with a reduced likelihood of dementia, so this could be a factor. However, for many I suspect the issue of personal identity is a strong motivator.

We almost certainly spend more time in the workplace than we do with our families. Whilst we might not be ‘industry leaders’ or ‘influencers’ a large part of who we are is influenced by what we do. I’ve met some incredibly passionate paraplanners who love what they do. Imagine you had been doing what you do for 30-40 years gaining great depths of experience, knowledge and wisdom. You probably have colleagues who come to you for help or to be a sounding board (irrespective of the chain of command). How would you feel about leaving that environment?

We are unlikely to fully comprehend. We might not be having these conversations directly with clients. However, we should try to have empathy. They are considering a huge transition of which money is only a part. So, as we prepare Retirement Planning reports, let’s be aware of the thoughts that might be going through our client’s heads.