Those planning for retirement should focus on the ‘what ifs’ rather than fixate on average life expectancy figures, says Just Group.

According to the retirement specialist, making retirement plans based on living to average life expectancy could hoodwink retirees into later life poverty. Fewer than half of today’s 65 year olds are expected to die within five years either side of their average life expectancy.

Stephen Lowe, group communications director at Just Group, said: “Applying average life expectancy figures to retirement planning doesn’t work because of the simple fact that individual people are very unlikely to be average.

“A better option is to think about the ‘what ifs’ of later life and to prepare for the range of possibilities. There are really three potential outcomes; you die around average life expectancy, you die sooner, or you live longer. A robust retirement plan needs to cover those three bases.”

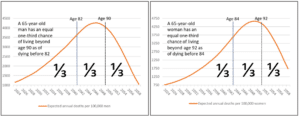

Official life tables give future expected mortality rates for each age group and gender. For men aged 65 in 2024, about one third are expected to die before age 82, another third are expected to die between 82-90, while a third are expected to survive beyond age 90. For women aged 65 in 2024, one-third are expected to die before age 84, another third are expected to live to 84-92 and the remaining third are expected to survive beyond age 92.

Lowe said: “None of us know how long we are likely to live and these charts (see below) remind us why we shouldn’t assume that we’ll be somewhere in the middle. Expecting to survive to around average life expectancy, the middle third of your age cohort, actually gives a two-thirds chance you will be wrong, which are not good odds when planning your finances.”

According to Just Group, with annuity rates well above 6% for a 65-year old, the current likelihood is that more than two thirds of people will get their investment back or more as secure income.

Lowe added: “We know that people worry about losing their investment if they die too soon but buying should never feel like a bet you can only win if you are lucky enough to live to a great age.

“Annuities are primarily about ease and peace of mind. They require no ongoing management, provide security to spend the income without worrying if it will run dry, along with the certainty that loved ones can benefit if the worst happens.”