Investment markets are moving into a new “golden age” of strong dividend returns, according to Mark Peden, investment manager at Aegon Asset Management.

With $1.6 trillion forecasted to be returned to investors in 2023, Peden believes we’re witnessing a seismic shift in the dividend returns outlook and a remarkable turnaround from the darkest days of the Covid crisis.

He says, “Almost exactly three years ago, in the depths of the Covid-induced market selloff, companies were cutting or suspending dividends left, right and centre and analysts were predicting big cuts to global dividends from which they would take years to recover.

“Yet for all the cataclysmic predictions, pay-outs took just one year to bounce back. Dividend pay-outs are forecast to hit record levels yet again in 2023 at an estimated $1.6 trillion. We have now gone from a dividend dilemma to a dividend deluge.

“With 2022 also setting a record for share buyback authorisations, the picture is clear – companies are returning record amounts of capital to shareholders. The volatility we saw last year served as a reminder that dividends are typically much less variable than earnings and can provide an important source of total return in challenging markets.”

Peden suggests that deep value investment propositions, which succeeded in 2022, have now likely run their course. Instead, investors should now look toward “quality” equities for their portfolios.

“Deep value areas of the market characterised by companies with lower-quality earnings and high debt levels had their day in the sun last year. Such rallies tend to be sharp but also short-lived, which played out in the first quarter of this year as we saw momentum fade abruptly.

“Investors are questioning whether such companies can continue to be successful in a recessionary environment. In addition, with interest rates looking like they will be higher for longer, indebted companies will see more of their cashflow eaten up by interest payments, rather than being available to distribute to shareholders.

In contrast to the riskier, deep-value end of the market, Peden believes a focus on quality dividend-paying companies – those with strong balance sheets and high returns on equity – can be a powerful driver in the long run and is likely to be especially important this year. He says, “The top quintile of companies, based on quality within the MSCI All Country World Index, has significantly outperformed the wider market over time. That quality factor should prove invaluable against a backdrop of slowing economic growth.”

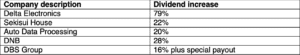

“Despite the uncertainty, over two-thirds of the companies held in our Global Equity Income Fund increased their dividend in the first quarter of 2023. Companies are returning record amounts of capital to shareholders and are doing so while recording pay-out ratios that are below long-term averages, meaning that these dividends should remain – even in the face of slowing growth.

2023 dividend increases within the Aegon Global Equity Income Fund:

Source: Aegon Asset Management

“What is striking about these examples is not only the magnitude of the increases but also the diversity of the companies involved, on both a geographical and sectoral basis, which implies broad-based strength. This quality approach will, we believe, be especially important if economic conditions become harsher still.

Ultimately, Peden says these indicators signify a “golden age” for dividend investing over the next decade. He also notes that in the short term, dividend income can provide much-needed stability in particularly choppy investment conditions.

“All of this suggests that we may be entering a golden age for dividend investing, where global dividends provide equity income investors with both opportunities and resilience in the years ahead.”

[Main image: ashin-k-suresh-mkxTOAxqTTo-unsplash]