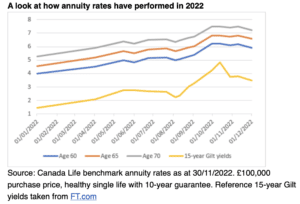

Annuities have made a “comeback” this year, according to Canada Life, with the firm’s average benchmark annuity rate up by 44% since January after hitting a 14-year high in October.

The investment management group said a combination of higher gilt yields and increased market competition had driven rates higher.

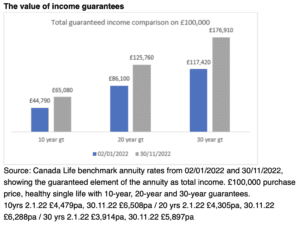

In a review of rates from 2 January to 30 November, Canada Life said a 30-year guarantee on a £100,000 initial purchase price would now pay £59,940 additional income compared to the start of the year, taking the total guaranteed income to £176,910.

Meanwhile, a 20 year guarantee would pay £125,760 total guaranteed income, up £39,660 on the start of the year, while a 10-year guarantee would pay £65,080, compared to £44,790.

Nick Flynn, retirement income director at Canada Life, said: “Annuities have made quite a comeback this year, with guaranteed lifetime income back in vogue following the strong improvement in rates. This has largely been driven by the positive shift in yields available on gilts, while competitors have also vied for market position.”

Flynn added: “For clients seeking income security in retirement, annuities can play a key role in retirement planning. It will always pay to shop around for not only the best rate, but also the right shape and type of annuity. Purchasing an annuity is a significant financial step and it is the role of advisers to help their clients understand the choices available and select the right annuity for a customers’ individual needs.”

Canada Life said its annuity quote volumes also increased by 58% over the course of the year.