Higher yields now make bonds an attractive alternative for stocks, says Stuart Chilvers, Rathbone Ethical Bond Fund Manager.

It wasn’t so long ago that one of the most popular acronyms in finance was TINA (‘There Is No Alternative’). The basic thesis was that, with interest rates and bond yields at historic lows, equities were the only game in town for investors looking for significant returns. At the peak of TINA in late 2020, more than $18 trillion of debt had a negative yield to maturity. That is, $18tn of debt that guaranteed investors would lose money if they held the bonds until they matured. How different things are a few years on!

Last year, the value of outstanding bonds with a negative yield fell to zero. So to our mind the relevant acronym is now TANIA – ‘There Are Now Investment Alternatives’. For instance, you would be forgiven for assuming that if you had invested in a gilt index you would have had a torrid time in 2025, given the seemingly never-ending headlines trumpeting the UK’s impending fiscal doom and long-dated gilt yields hitting multi-decade highs. But at the time of writing the ICE Bank of America UK Gilt Index has returned 2.1%. And the ICE BofA Sterling Corporate index has returned 4.5% over the same period (it’s shorter duration and you have benefited from the extra spread for taking corporate default risk). We think this highlights two significant points:

- In our view there’s a significant degree of pessimism priced into UK government bonds. Hence, despite the gloomy headlines referenced above and what’s a relatively long duration index by global standards, year-to-date total returns are still positive. Also, we think the market is underestimating the number of rate cuts that the Bank of England (BoE) will be able to make over the next 12 months.

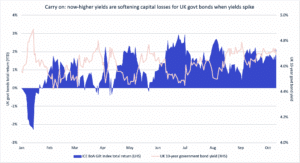

- At current yields, bonds have a significant buffer in terms of being able to suffer capital losses from rising yields and still offer a positive return over a 12-month period. This is a huge change from a few years ago, where extremely depressed yields meant a very small move in yields could eliminate your entire return for the year.

Source: FactSet; data to 10 Oct 2025

In fact, on this second point, we are now at a place where 10-year gilt yields are closer to equity earnings yields (using the MSCI AC World Index 12m forward earnings yield) than they have been for 20 years. Now, it’s worth reiterating that is the earnings yield, not the dividend yield (which tends to be much lower). The complaints that bonds don’t even offer attractive income relative to stocks have been quiet for some time – the weighted average coupon on the ICE BofA Sterling Corporate index is not far from 1% above its nadir in 2022, and it would be a brave person who bets against that trend continuing for some time, given its current level of 4.6% is below the 10y gilt yield to maturity at the time of writing.

As has been incredibly well covered over the last couple of years, part of the reason for bond yields being at these much higher levels is the large and swift rate-hiking cycle of the past few years. While this was undoubtedly painful for bond investors, it now presents a potentially interesting opportunity.

Whereas a few years ago rates were at or near their lower bound, there’s scope for significant rate cuts if the economic environment necessitates it (albeit this is not our base case). So this leaves us in a situation where we are being paid an attractive yield to own bonds, and there’s the potential for a significant move lower in yields (and hence higher bond prices) if the economic environment were to significantly worsen. We think this makes investment grade bonds interesting from a portfolio perspective and reinforces our belief that we are now in a TANIA environment.

This is a financial promotion relating to a particular fund. This information should not be taken as investment advice or a recommendation. When you invest your capital is at risk and you could lose some or all of your investment.

Main image: kseniya-lapteva-K0wseIXrs3I-unsplash