Investors are shifting their focus away from US markets amid growing demand for global diversification, says Fidelity International.

The trend, which first emerged in February as interest in technology stocks declined, became more pronounced in March as investors pulled back from not just large-cap tech but also from US smaller companies.

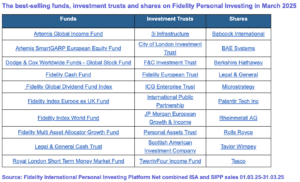

For the first time this year, US-focussed funds dropped out of Fidelity’s top ten selling funds in March, highlighting a broader reluctance to maintain US exposure.

Ed Monk, associate director at Fidelity International, said: “In recent months, US technology stocks have dominated investor demand, but March’s data tells a different story. None of the Magnificent Seven appeared among the most traded shares, signalling a shift in focus towards areas offering more resilience in the current environment.”

While investors have reduced their US exposure, Monk said they have not turned away from equities altogether, with a clear preference for globally diversified funds and European markets.

Funds such as Fidelity Index World Fund, Dodge & Cox Worldwide Global Stock Fund and Artemis SmartGARP European Equity Fund continue to be popular.

Investors are also adopting a more defensive stance amid concerns over trade tariffs and growing economic uncertainty, increasing their allocations to cash and lower-risk assets, the firm said. Three cash funds; Fidelity Cash Fund, Royal London Short-Term Money Market Fund and Legal & General Cash Trust now rank among the most popular investments.

Monk added: “With market uncertainty persisting and the tax year end approaching, we’ve seen a strong move towards cash and defensive assets.

“Meanwhile, infrastructure investments have gained traction, reflecting demand for inflation-resistant assets with stable income potential. The continued popularity of International Public Partnership and the new entrant of 3i Infrastructure show that investors are turning to essential services and transport infrastructure as defensive plays in an uncertain market.”

Main image: pawel-czerwinski-HKHwdinroSo-unsplash