Paraplanners feel confident of long term market performance but economy concerns weigh heavier, our latest Parameters survey reveals.

Paraplanners are feeling confident about the long-term performance of financial markets, but UK economic concerns are weighing heavily, according to Professional Paraplanners’ latest Parameters survey.

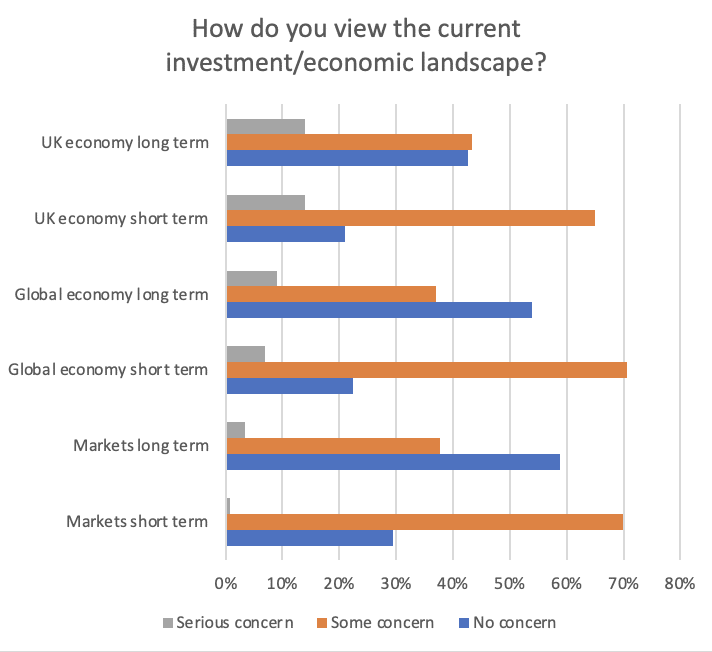

Nearly six in ten (59%) paraplanners said they had “no concerns” about the long-term markets, with just 38% expressing some concern and 3% expressing serious concern.

However, paraplanners admitted to feeling worried about the UK economy, in the wake of Brexit and the Covid-19 pandemic.

Nearly two thirds (65%) of respondents said they had some concern around the UK economy short-term, while 14% said they had serious concerns. Meanwhile, 43% of respondents said they felt some concern about the UK economy over the longer term, with 14% also expressing serious concern.

One respondent noted: “Brexit has been a disaster so far and if Article 16 is triggered, it will get worse and Covid still causes a shadow over the whole globe.”

A second said the uncertainty around the pandemic posed a challenge: “I think things are incredibly uncertain currently; no one know how Covid will progress in the UK or globally and it’s difficult to predict what changes the enforced lockdowns have made to society going forward.”

Another commented: “The post-Brexit, post-Covid economic world must be impacted in some way, especially with such a sharp rise in prices across the board, and I think economics will be heavily impacted in the short term, although hopefully we will ride this out and the long term will see more stability.”

Paraplanners also raised concerns about the impact of climate change on the UK’s long-term economic growth.

One respondent explained: “I feel like something is brewing over the short term. The Covid recovery seemed to be too fast, especially considering the rate of vaccination in the developing world. Over the longer term I believe the climate crisis will mean more frequent market stress which cannot be sustainable.”

This sentiment was echoed by others.

One paraplanner said: “Obviously some short term issues continue with recovery from the pandemic and Brexit. In the long term, the potential failure to address climate change adequately is a major systemic threat.”

Among those who felt no concern over the UK’s short or longer term economic prospects (21%), most pointed to the markets’ ability to bounce back.

According to one paraplanner: “Longer-term, history shows us that markets work out and as humans we progress and prosper. Investors should continue investing, blank out short-term market noise and concentrate on their longer-term goals.”

Seven out of ten (71%) paraplanners also said they felt concern over the short-term global economy, compared to just 22% who said they had no concerns.

One paraplanner said: “Global economies are likely to continue to struggle in the short term with global supply shortages and lingering effects of Covid. Overpriced assets in some regions and rising inflationary pressure are also slight short-term concerns for markets. However, long-term as always, there are no concerns.”

Despite this, one respondent said that paraplanners and advisers should concentrate less on markets and more upon those variables they have control over.

“A minimum investment timeframe of at least five years, means that we should not be trying to second guess the future of markets. The pandemic could not have been predicted and therefore it is best to plan for the variables that can be controlled and markets are not something that can be controlled,” they noted.