Andrew McCaffery, CIO of Alternatives and Solutions looks across the globe and gives a pan-asset class view of where he believes the winners and losers might be for the year ahead. Will we finally see the pre-eminence of the US economy and its financial markets challenged?

In recent years, the US has led the global economy and capital markets, buoyed by supportive monetary and fiscal policy. In 2020, we may have more of the same or there could be a moment of reckoning, with a distinct capital shift away from the US towards areas such as emerging markets.

I believe the latter is more likely, driven by US electoral concerns. Much depends on US corporate and consumer confidence and the direction of the dollar, but non-US assets, alternatives and income-generating plays could provide a useful way to navigate this environment.

US corporates are less confident than consumers

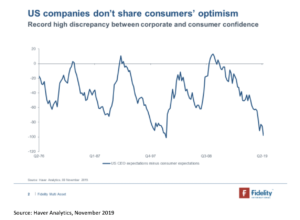

The US consumer is still strong even though the industrials sector is in recession. But as the chart below shows, US companies do not share consumers’ confidence. Following a period of high debt issuance to buy back shares amid little real revenue growth, companies – bar a few sectors such as technology – are losing their willingness to borrow. They could even start to reduce issuance and take liquidity from the market.

While this may strengthen the balance sheet at a single company level, at a market level, it could create a liquidity squeeze that tightens conditions for more highly-levered firms.

US companies don’t share consumers’ optimism

Source: Haver Analytics, November 2019

Leverage loan issuance is significantly down in 2019, while the initial public offering market has struggled with the misallocation of capital into some of the newer, disruptive companies with only speculative potential to generate profits. This could further depress corporate appetite for raising new capital. If issuance falls away more broadly, concerns about the default cycle and recession will percolate through from high yield to investment grade, putting yield spreads at risk.

US election risk could further impact confidence

While Federal Reserve policy will likely remain dovish, it cannot prolong the cycle indefinitely. In this climate, fears of post-election tax hikes (and regulation) could encourage even more companies to run for cash. So the big risk for investors in 2020 is that Elizabeth Warren gets the Democratic nomination and markets retreat as liquidity conditions begin to deteriorate. Private capital too is likely to be a target for Warren, given her focus on corporate taxes.

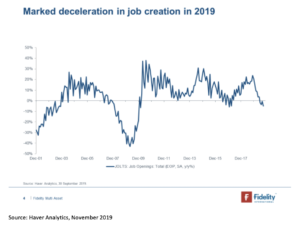

While the US consumer kept the economy out of recession in 2019, there are indications that employment may be nearing a peak. New job offerings turned negative in 2019 and may remain so in 2020. If consumers, like corporates, begin to believe their taxes will increase, consumer activity could grind to a shuddering halt.

Marked deceleration in job creation in 2019

Source: Haver Analytics, November 2019

Non-US assets could outperform

This may appear a somewhat pessimistic view. But from a multi-asset perspective, it offers a chance to generate returns via tactical allocations and to guard against risks. It also demonstrates the benefits of diversification. If a capital rotation occurs, there will be more opportunities outside the US, particularly in emerging markets and Europe.

Japan’s improvements in corporate governance are also interesting. The recent tax hike there may, for the first time in 20 years, create better conditions for investors. If people start to believe that prices aren’t going down any more, Japan will be on a different path to almost every other large economy.

Chinese influence is not going away

The direction of the dollar remains key for emerging markets. Any dollar weakness on the back of US uncertainty could spark relative outperformance across a range of economies. For me, the dynamics in places like Indonesia look more attractive than, for example, Singapore or Korea. Countries such as Vietnam and Cambodia that have benefited from shifts in supply chains should also not be overlooked.

China is going through a natural progression from a developing to a developed economy. There are risks in terms of the asset/debt profile and the amount of zombie businesses. But the authorities still have scope to use currency and capital reserves to offset debt issues. I remain unconvinced that the Chinese want anything other than a purely manufacturing deal with the US as their consumer sector matures. Over the next decade, wealth generation in China and Asia is set to continue and the broader China influence is not going away.

Alternatives: renewables and royalties

Another means of navigating a more challenging environment in 2020 is through more defensive positioning, via hedging, long-volatility strategies and income-generating alternatives. Examples include sustainable infrastructure such as renewables and potentially investments that offer income from high quality royalties. Cash levels may rise but only in order to rebalance and reallocate at better entry levels.

We are approaching a moment of reckoning. Either the cycle turns or rolls on until the US election. While 2019 was about the US-China trade talks, Brexit and renewed monetary stimulus, 2020 could be an inflection point for profits and liquidity. Corporate concerns about borrowing will only increase if the Democrats appear likely to win the US election and central banks may have little left in the tank to combat these late-cycle dynamics. If the dollar weakens as a result, this could be an opportunity for non-US assets.

Key points:

- 2020 could bring more of the same – dovish monetary policy and US pre-eminence – or mark a distinct shift of capital to other areas of the world.

- US companies are less confident than consumers and could reduce borrowing and investment.

- Tactical allocations to non-US assets such as emerging markets, alongside alternative investments and income-generating assets, could help navigate the year ahead.