Sponsored article

John Bellamy, managing director and head of Adviser Solutions at Waverton Investment Management, outlines the advantages of using a Managed Portfolio Service and the building blocks approach taken by Waverton within its MPS.

A Managed Portfolio Service (MPS) (sometimes called a Model Portfolio Service) is a centrally run set of portfolios, or mandates. Each mandate covers a different risk profile (for example, cautious) and holds an identical set of investments for all its investors. The mandates are managed by a central team who make all the investment decisions, what to buy, sell or hold in order to meet the return objectives according to the level of risk appropriate for that mandate.

While there may be requirements for a more bespoke portfolio in certain circumstances, it may be unnecessary in many cases. In these situations, an MPS can provide an efficient, cost-effective solution for a broad range of investors.

What are the key benefits?

- Managed portfolios are a cost-effective way of accessing a diversified and actively managed portfolio of investments

- Clients can easily move their capital from one mandate to another as their attitude to risk changes over time and/ or their income requirements change

How do I invest in MPS?

As the demand for MPS solutions has grown, it has become more widespread and easier to invest. Professional advisers can access MPS services on their client’s behalf, directly from the investment manager or via an investment platform.

The benefits of an investment manager’s MPS

An MPS offers a more coordinated approach to investing, where the balance of exposures to different risks can be expertly managed, rather than a more onerous approach of self-investing. An MPS is also able to access institutional assets, that private investors cannot.

Additionally, compared to buying a single fund, an MPS approach can not only offer a diversity within a portfolio, but can offer access to fund managers for meetings and updates and select tax-efficiency benefits. Advisers can also use the MPS on platform alongside cash-flow planning or a decumulation strategy.

What makes Waverton’s MPS special?

Launched in 2012, Waverton’s MPS has a ten-year track record and has achieved an impressive outperformance* since inception, and there are several features that we believe sets it apart from more standard, or traditional approaches:

- With a dedicated, expert investment team, the Waverton MPS includes our very best investment ideas from around the world

- We have proprietary downside protections which help prevent serious losses during periods of extreme market volatility

- With our integrated approach to consideration of environmental, social and governance (ESG) factors, Waverton’s MPS has Responsible Investment embedded throughout the mandates

Building blocks, not a portfolio of funds

A traditional MPS uses a portfolio of funds approach, which involves paying a manager to coordinate a selection of third-party funds, all of which have their own managers and investment philosophies and fees.

Waverton’s MPS has a genuinely innovative structure, comprised of four ‘building block’ funds which are run by our dedicated investment team. We then offer strategic mandates made up of different proportions of these components to cater for different risk profiles. These weightings can then be adjusted tactically when deemed necessary, with minimal friction.

While also available on a standalone basis, these funds are run specifically for the Waverton MPS and are coordinated on a cohesive, complementary basis. This allows for a truly multi-asset portfolio that suits our clients’ needs. The funds that provide the building blocks are:

- Sterling Bond Fund

- Strategic Equity Fund

- Absolute Return Fund

- Real Assets Fund

The building block structure also allows for consistency across a wide range of platforms. For other managers, a particular component fund might not be available on all required platforms. They could then be forced to compromise by either selecting a substitute fund that is available across all of their platforms, or resort to buying different funds on different platforms which would affect the consistency of client outcomes. Portfolio-of-fund type MPS are also more limited in their ability to own investment trusts – removing a potential source of diversification and return.

This structure also allows the holding of a considered amount of cash, rather than a combination of cash allocations spread across a range of funds, as might be the case in a portfolio-of-funds MPS.

Truly active investment

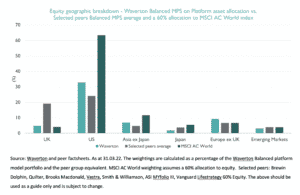

There are several advantages to managing the components of the MPS in-house; firstly, investing directly, where we own the assets (shares, bonds etc) ourselves, gives us a better understanding of the exposures and risk in the mandate allowing more effective reaction to their changes**. The mandates include the traditional equity and fixed income asset classes but complement this with two funds of alternative assets. Including exposure to areas like property, infrastructure, shipping and music royalties allows streams of less correlated returns. Our global approach also allows a more diverse selection, while many of our peers tend to focus on UK equities.

This structure also allows for the equity component to include an allocation to our proprietary Protection Strategy, a sophisticated hedging product that is designed to increase in value during periods of acute market stress. It acts similarly to a form of insurance.

Specialist and cohesive

The Waverton MPS format allows members of the team to specialise in their roles. Our building block funds are run by specialist managers and the weights attributed to each is overseen by the Asset Allocation Committee. The team in charge of managing your investments spend their time doing just that, they are not also looking after clients, advisers or focusing on attracting new business.

Responsible investment

Environmental, Social, and Governance ramifications – both positive and negative – are included in all asset classes at all stages, this means that there is a consistent approach rather than a combination of manager approaches.

Clear reporting

The structure also allows clients to get a full ‘look-through’ of their underlying holdings, showing what assets are held and in what quantities. This is produced quarterly but is also available on an ad-hoc basis.

Summary

The last decade has seen a rapid rise in the popularity of discretionary managed portfolio services, and they have proved to be a convenient and effective solution for a wide range of clients. We fully expect this trend to continue in the years to come as we can offer institutional-grade investment at more competitive prices. We feel the Waverton service is expertly placed to manage the changing investment landscape while meeting the ever-evolving requirements of financial advisers and their clients.

* Further information on performance is available on request.

** Although the majority (c. 80%) of the Waverton MPS is owned directly, within the four building-block funds, we have the option to buy third-party funds to access niche or tactical areas of the market (e.g. Indian equities) where we feel that the fees justify the specific expertise of the manager.