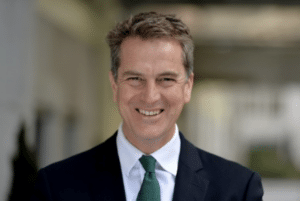

Peter Michaelis, Head of the Liontrust Sustainable Investment team, explores the pressing question: What does Trump’s energy policy mean for investors, in particular, as the new US Energy Secretary does not support 2050 net zero target?

The new US Energy Secretary will be Chris Wright, CEO of Liberty Energy, a US shale gas producer. The natural assumption is that he will do all in his power to encourage fossil fuel growth. The 30% rise in Liberty’s share price since his appointment supports this idea. It is tempting to put him in the category of climate change denial and being slavishly pro-hydrocarbon. His position is actually more subtle.

He does not deny climate change is an issue, just that it is of much less importance than the higher goal of delivering abundant, affordable energy for all. With universal cheap natural gas, he contends, energy poverty could be ended. The two million deaths each year associated with indoor air pollution from biomass cooking would be prevented. He also argues that the costs of climate change this century will be low and that adaptation costs are far smaller than the costs of transitioning away from fossil fuels. Therefore, he does not support a 2050 target for net zero emissions.

We think he has got this wrong. Even if we put aside scepticism about the Trump regime having global energy poverty reduction as a key goal, his argument is both short-sighted and underplays the uncertainty in the range of impacts from a warming world.

Emissions impact is cumulative, and climate change is inter-generational

2024 hit another extreme in global temperature rise – one that the climate models did not anticipate, particularly with regard to the rise in ocean temperatures. While it is hard to explicitly link individual weather events (or LA fires) to this warmer world, the broad view of scientists is that an Earth that retains more energy has more potential for extreme weather. In addition, climate change is an inter-generational issue. Saying that the effects this century will be limited and so no action needs be taken prioritises the current generation very much at the expense of those that will live in the 2100s. Carbon emissions are cumulative and there is a time lag in their impact (e.g. sea level rises from Greenland ice melting will take many decades to occur).

Renewable energy is already abundant and affordable

The other major flaw in Wright’s view is that it overlooks that renewable energy is already delivering on both goals of abundance and affordability. The learning curves of solar and battery manufacturing mean that these will continue to get cheaper as productive capacity grows – driving down the costs of providing energy without having to rely on fossil fuels. In addition, natural gas conversion into electricity is ~40% efficient, whereas solar is direct into electricity. It is for this reason that solar capacity in Texas, for instance, has grown nine-fold since 2019, to 19GW.

We therefore believe that the new energy secretary will find it hard to change the growth trajectory of renewables, and the associated decline in the portion of electricity generation coming from fossil fuels.

As a reminder, during the last Trump Presidency coal-fired generation declined rapidly. We believe that our investments linked to energy generation and energy efficiency will perform well in the coming years, even in the US.