Investors who flee to cash tend to do so in two key periods, potentially losing out on tens of thousands of pounds, according to data from Seven Investment Management.

A move to cash when large crashes occur is a common response but timing the market is almost impossible, says senior investment strategist Ben Kumar (pictured).

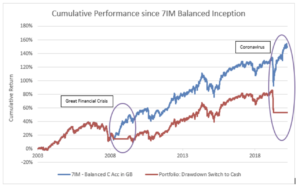

Investors who retreated to cash during the financial downturn and again in 2020 will have been left £100,000 worse off than investors who held their nerve. As an example, 7IM said if an investor had started with a £100,000 investment and remained invested they would now have £250,400. In contrast, an investor with £100,000 who moved to cash would have £150, 430.

Kumar says: “The investment facts are clear. Moving to cash and trying to time the market doesn’t always work. No one calls the top successfully and no-one calls the bottom either. Stay invested, it sounds simple and it is simple. But for many investors the simplest thing to do is often the hardest. Moving to cash is always tempting, because the basic instinct in our heads is loss-aversion.”

Kumar says there are two “particularly dangerous periods” that test investors’ resolve; when things go wrong and stock markets suffer sharp falls; and again when markets recover but investors panic about further falls.

Kumar adds: “Questions start to creep in, with people asking whether they should sell now, and buy back in lower down ‘when the market falls again’. Or they’ll ask whether the market has gone too far, and if now is the time to hold cash.

“Unfortunately, the economics don’t always matter when someone is scared. The desire to hold cash comes from a psychological place, not an economic one. Our view though is that abandoning a long-term investment plan due to short-term fears is, and will always be, a bad idea.”

Source: 7IM. NB: The above chart is based on past performance which is not a guarantee for future performance. The above chart is based on investment in 7IM Balanced C Acc since inception at 12 December 2003 vs the same portfolio which moves to cash during the periods 03/03/09- 03/03/10 and 23/03/20- 11/03/21.