Exhibiting an extensive track record of outperformance versus big caps and offering good diversification from traditional equities, Asian small-cap stocks provide numerous investment merits for long-term investors, says Grace Yan, senior portfolio manager, Nikko Asset Management.

Asian small capitalisation (cap) stocks, which were largely overlooked by the markets from 2016 to 2019, have started to capture the attention of investors of late, owing to the strong gains they have racked up since March 2020 when global equity markets hit a bottom at the onset of the COVID-19 pandemic.

Over the 12 months ended 31 March 2021, regional small caps, as measured by the MSCI AC Asia ex Japan Small Cap Index, returned more than 80% in US dollar (USD) terms, outperforming their large- and mid-caps peers (as measured by the MSCI AC Asia ex Japan Index), which generated USD gains in excess of 50%.

With the regional economic recovery currently in full swing, boosted by vaccine-led optimism, ample liquidity in the global financial systems and a pick-up in corporate earnings, Asian small caps—currently in the early stage of a sustainable rebound—should maintain their upward momentum in the foreseeable future, in our view.

On top of the favourable short-term outlook, Asian small-cap stocks’ longer-term prospect also looks promising. As we see it, the investment case for Asia’s smaller and lesser-known listed companies with an undersized market cap currently looks strong. We explain in detail the traits, opportunities and appeal of Asian small caps and the benefits of investing in this unique equity asset class.

Nimble and fast growing

Nimble, fast growing and at an early stage of development, small-cap companies have the ability to seize market opportunities at a quick pace and generate exceptional earnings growth. To be sure, innovative smaller companies with robust business models and scalable strategies could grow exponentially, particularly if their niche products or services are successful. The essence of small-cap investing is finding the big winners of tomorrow.

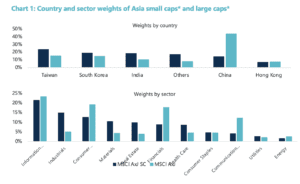

Small and large caps have different country and sector weights

Asian large caps have a larger weight in China versus regional small caps. The large caps of Asia also have higher percentage of weights in sectors, namely financials and consumer discretionary, relative to small caps, which have more exposure in industrials, materials, real estate and healthcare (see Chart 1). As such, investing in small caps do allow for greater diversification from other traditional equity strategies, which tend to be large-cap centric.

Chart 1: Country and sector weights of Asia small caps* and large caps*

Source: MSCI, 28 February 2021

*Asian small-cap stocks in the above chart are represented by the MSCI Asia ex Japan Small Cap Index, while regional big-cap stocks are denoted by the MSCI Asia ex Japan Index.

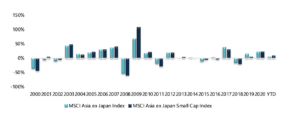

A long track record of outperformance

Over the past two decades, Asian small caps (as measured by the MSCI Asia ex Japan Small Cap Index) have outperformed their bigger-cap counterparts (as measured by the MSCI Asia ex Japan Index) 64% of the time. In addition, regional small caps have significantly outpaced Asian large caps during distinct periods, especially phases of recovery after a major market selloff, such as in 2001, 2009 and the first quarter of 2021 (see Chart 2).

The 20-year track record of outperformance of Asian small cap versus large caps certainly gives comfort to long-term investors that having some exposure to stocks of regional smaller companies could enhance the overall returns of their equity portfolios over the long run.

Chart 2: Asian small caps* outperformed regional big caps* 64% of the time in the past 20 years

Source: Bloomberg, 31 March 2021

*Asian small-cap stocks in the above chart are represented by the MSCI Asia ex Japan Small Cap Index, while regional big-cap stocks are denoted by the MSCI Asia ex Japan Index, all of which are quoted in US dollars. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

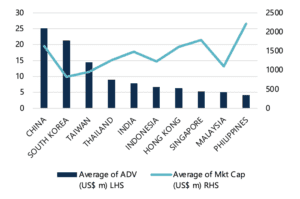

Regional small caps have ample liquidity

Small caps tend to have thinner trading volumes as compared with their big-cap counterparts; but that doesn’t imply that all Asian small caps are illiquid. Small-cap stocks that are listed in the North Asian markets, such as China, South Korea and Taiwan, generally have ample liquidity, as measured by the average daily value (ADV) of trades (see the Chart 3). For instance, the ADV of equity trades in China averages USD 25 million a day, while that of South Korea exceeds USD 20 million each day.

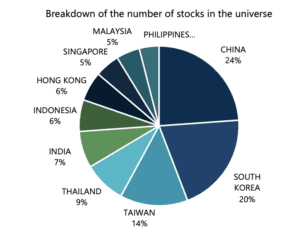

Another key point pertaining to liquidity is that the bulk of stocks in the Asian small-cap universe comes from China, South Korea and Taiwan—three of the most liquid Asian equity markets for small caps. The fact that the liquid markets of North Asia is home to more than half of all Asian small-cap stocks in the universe (see Chart 4) debunks the myth that most regional small caps are illiquid.

Chart 3: Small-cap ADV by country

Source: Bloomberg, 31 March 2021

Data set is based on our small-cap investable universe: USD 200 million to USD 5 billion in terms of market cap, 3-month ADV > USD 1 million

Chart 4: Percentage of stocks per market in the Asian small-cap universe

Source: Bloomberg, 31 March 2021

Data set is based on our small-cap investable universe: USD 200 million to USD 5 billion in terms of market cap, 3-month ADV > USD 1 million

Access to a larger opportunity set (cont over page)

Page: 1 2