Access to a larger opportunity set

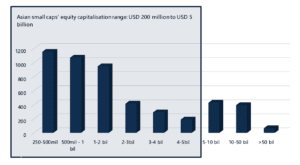

The large number of Asian small-cap companies, many of which are relatively unknown to investors, represents potentially overlooked opportunities. At the outset, there are over 2,000 regional small-cap stocks with a market cap of less than USD 1 billion and more than 1,000 counters with a market cap of between USD 1-3 billion to choose from versus a universe of less than 500 big-cap stocks with a market cap of between USD 5-10 billion (see Chart 5).

Chart 5: Number of companies by market-cap band (USD)

Source: Bloomberg, 31 March 2021

Data set is based on our small-cap investable universe: USD 200 million to USD 5 billion in terms of market cap, 3-month ADV > USD 1 million

Likewise, there are more small-cap benchmark stocks in the region than benchmark stocks in the big- and mid-cap category. To illustrate, there are more than 1,400 stocks in the MSCI Asia ex-Japan small-cap universe as compared with 1,182 stocks (as at 31 March 2021) that are constituents of the MSCI Asia ex Japan Index, which captures large- and mid-cap representation in the Asia ex-Japan equity markets.

All things considered, the large opportunity set in the Asian small-cap universe offers active investors a wider scope to select stocks from the bottom up and sniff out the potential small-cap winners and avoid the losers.

Lack of coverage of small caps gives opportunities to capture alpha and unearth gems

Investing in Asian small caps truly encapsulates the essence of active equity investing, in which stock selection adds value and drives alpha in this under-researched equity space (alpha is generally defined as returns in excess of a benchmark’s performance). We believe that there is a lot of price inefficiency in the Asian small-cap market, where stock prices do not accurately reflect their true value.

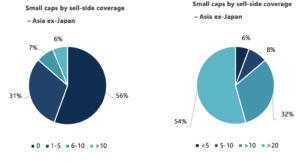

Indeed, more than half of all Asian small-cap stocks in the investable universe are not covered by any sell-side equity analysts (or analysts from brokerages) and only 31% of them have coverage from sell-side analysts numbering one to five (see Chart 6). In contrast, a typical Asian large-cap stock is covered by at least 10 sell-side analysts.

In our view, the limited sell-side coverage of regional small caps offers opportunities for active investors to capture alpha and unearth “hidden gems” due to the mispricing in the Asian small-cap equity market, where there is a large information gap to exploit.

Chart 6: Small- and large-caps’ sell-side coverage (denoted by the number of analysts)

Source: Bloomberg, 31 March 2021

Data set is based on our small-cap investable universe: USD 200 million to USD 5 billion in terms of market cap, 3-month ADV > USD 1 million. Large caps are defined as those with a market cap of more than USD 5 billion.

Backed by strong and committed shareholder base

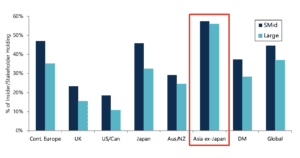

Small- and mid-cap companies generally have higher family and management ownership (see Chart 7), representing more “skin in the game” or higher vested interest of the owners, which share an aligned goal towards success with minority shareholders. Family and management ownership, akin to higher insider ownership, are stakeholders who tend to be more committed to their owned companies than hired CEOs, managers and executives, all of whom have relatively less “skin the in game”.

Chart 7: Insider stakes of small- and mid-caps vs large caps

Source: Bloomberg, FactSet & JP Morgan, 31 March 2021

Having a strong, committed and entrepreneurial management team could be the driving factor of success for many of the smaller companies, which tend to be more financially constrained and more vulnerable to product failures, dramatic slowdown in sales or a surge in the cost of capital as compared to bigger companies.

Summary

We see a strong investment case for Asian small caps, which have different country and sector weights relative to their bigger-cap peers; a long track record of outperformance; and ample level of liquidity. The large number of small caps in the region and their under-research nature also give investors a wider scope to select stocks from the bottom up and sniff out hidden gems and capture excess returns.

Nimble, fast growing and at an early stage of development, small-cap companies have the ability to seize market opportunities at a quick pace, generate exceptional earnings growth and grow capital faster than their big-cap counterparts. That’s why investing in Asian small-cap stocks remains a potentially lucrative proposition for long-term investors, in our view.

Important information: This document is prepared by Nikko Asset Management Co., Ltd. and/or its affiliates (Nikko AM) and is for distribution only under such circumstances as may be permitted by applicable laws. This document does not constitute personal investment advice or a personal recommendation and it does not consider in any way the objectives, financial situation or needs of any recipients. All recipients are recommended to consult with their independent tax, financial and legal advisers prior to any investment.

This document is for information purposes only and is not intended to be an offer, or a solicitation of an offer, to buy or sell any investments or participate in any trading strategy. Moreover, the information in this document will not affect Nikko AM’s investment strategy in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Nikko AM makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this document. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. This document should not be regarded by recipients as a substitute for the exercise of their own judgment. Opinions stated in this document may change without notice.

In any investment, past performance is neither an indication nor guarantee of future performance and a loss of capital may occur. Estimates of future performance are based on assumptions that may not be realised. Investors should be able to withstand the loss of any principal investment. The mention of individual securities, sectors, regions or countries within this document does not imply a recommendation to buy or sell.

Nikko AM accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this document, provided that nothing herein excludes or restricts any liability of Nikko AM under applicable regulatory rules or requirements.

All information contained in this document is solely for the attention and use of the intended recipients. Any use beyond that intended by Nikko AM is strictly prohibited.

Page: 1 2