Missing the 20 best days in past 20 years could have cut final your investment value by 43%, points out Annabel Brodie-Smith, Communications Director of the Association of Investment Companies.

All over the world, equity indices are hitting fresh all-time highs. The S&P 500 has set over 20 fresh records this year, while the FTSE 100 has finally notched a series of record closes.

With so many markets having enjoyed a stellar run, wary investors could be forgiven for wanting to take their profits. But analysis by the Association of Investment Companies (AIC) shows how costly it can be to sell up and try to time the market – missing just a few of the best days can have a devastating impact on performance over time.

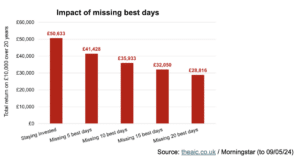

If you had invested £10,000 in the average investment trust 20 years ago and left it untouched, your money would have grown to £50,633 by today1.

However, if you had missed just the five best days in the market, that figure would have dropped to £41,428 – 18% less. Miss the ten best days and your investment would be worth £35,933, 29% less than if you had been invested through the whole period.

If you’d missed the 20 best days you would have lost out on almost half the amount you would have enjoyed had you just sat on your hands, with a final total of just £28,816, 43% less than the full 20-year return of £50,633.

Unfortunately, the best and worst days in the market tend to come during periods of intense volatility, which can be stomach-churningly stressful for investors as they see big swings in the value of their portfolios. This can lead to knee-jerk decisions, such as selling at the wrong time. Nobody knows when these fantastic days in the market are going to come, so it makes sense to stay invested to ensure you capture those days of strong performance.

The importance of staying invested was perfectly demonstrated when the market crashed due to the Covid pandemic. Even if our fictional investor had seen the pandemic coming and sold out of their investment trusts for the entire 2020 calendar year, they would still have less today than if they had simply stayed invested for the whole 20-year period:£47,478 versus £50,633. That’s because they would also have missed the historic rally that followed the short but steep bear market.

Another good thing about staying invested during downturns is that it gives investment managers a chance to pick up quality shares at bargain prices, which can really turbocharge returns as they rebound from their lows. So unless you get incredibly lucky, it pays to keep faith in stocks and shares and ride out the rough times, as long as you have a sufficient timeframe to allow your investments to recover.

1.Source: theaic.co.uk / Morningstar. All performance figures are for the 20 years to 09/05/24, with days omitted as indicated. Share price total return, average investment trust ex VCTs.