M&G Wealth has launched a new tool to help advisers and paraplanners calculate whether their clients could benefit from a Transitional Tax-Free Amount Certificate ahead of the abolition of the Lifetime Allowance (LTA) in April. Also launched is a new and improved technical hub: Tech Matters.

The LTA is to be abolished from April and is replaced with three new allowances: the Lump Sum Allowance (LSA), the Lump Sum and Death Benefits Allowance (LSDBA) and the Overseas Transfer Allowance (OTA).

In an adviser poll conducted by M&G Wealth in December, over three quarters said they were either unsure or did not have enough information to advise their clients on the LTA rules as they will be from April.

One of the additional planning considerations during this tax-year end period is that clients who have accessed pension benefits under the ‘pre-April 2024’ Lifetime Allowance regime will have their standard ‘post-April 2024’ Lump Sum Allowance and Lump Sum and Death Benefit Allowance reduced under the transitional rules.

M&G Wealth’s new LTA Transitional Tax-Free Amount tool supports advisers by identifying the standard Lump Sum Allowance, calculating reductions based on default transitional rules and under Transitional Tax-Free Amount Certificate rules, and easily recognises whether allowances are higher under default or certificate rules. Under the new rules, one scenario shows an increase in the potential tax-free amount by over £110,000.

The M&G Wealth technical team provide this example: Under the current rules, if someone has used 80% of the £1,073,100 Lifetime Allowance, the maximum tax-free cash they can take is 25% of their remaining Lifetime Allowance, which would be £53,655, regardless of how much tax-free cash they have previously taken. Under the new rules, the Lump Sum Allowance is reduced by 25% of the Lifetime Allowance previously used – which would be £214,620. However, if they can prove they have only taken £100,000 previously, they can get a Transitional Tax-Free Amount Certificate which allows a lower reduction – so increasing the potential tax-free amount by £114,620.

Transitional Tax-Free Amount Certificates are provided by a registered pension scheme and are used to prove that the scheme member is entitled to a lower reduction in the LSA and LSDBA than that provided for by the standard default calculation.

M&G Wealth has also launched a new and improved online technical hub Tech Matters, which brings together content from the M&G Wealth’s team of pension and tax technical experts together in a newly-designed website.

As well as the new LTA tool, the website hosts a huge range of resources for advisers and paraplanners, from helpful tools and calculators to the latest technical insights and hot topics.

Les Cameron, head of M&G Wealth’s team of pension and tax technical experts, said: “Tax-year end is rapidly approaching and the LTA abolition is providing an added twist. The number one question we’re being asked is whether clients will be able to access more tax-free cash under the new rules, so we’ve developed an easy-to-use tool based on three simple inputs to provide the answer, which we believe is the first of its kind.

“While the LTA abolition is currently the hot topic, we pride ourselves on providing up-to-date technical news and insights on a range of subjects from regulatory changes to tax planning, which is why we’ve launched the new Tech Matters hub, making our content even easier for advisers and paraplanners to access.”

Professional Paraplanner is pleased to announce that the M&G Wealth technical team will once again be joining our Technical Insights Seminars roadshow, presenting to paraplanners around the country. You can register for a seminar near you HERE.

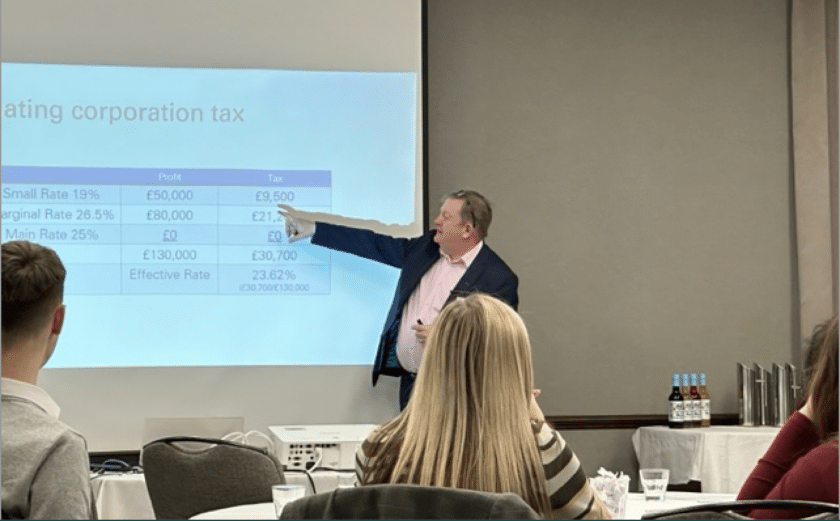

Main image: Les Cameron presenting at the Technical Insight seminars 2023.