In the second of a three part article covering what you need to know about top slicing relief, the M&G Wealth Technical Team cover top slicing calculations.

Article 1 looked at what top slicing is and how it works and articles 3 will cover FA 2020 top slicing measures.

HMRC adopt a five step procedure as follows when calculating top slicing relief:

Step 1: Calculate the total taxable income for the year and identify how much of the gain falls within the starting rate for savings, personal savings allowance nil rate, basic, higher or additional rate bands as appropriate. Any gift aid payments must be disregarded both in this computation and in the remaining steps below.

Step 2: Calculate the total tax due on the gain across all tax bands. Deduct basic rate tax treated as paid* to find the individual’s liability for the tax year.

Step 3: Calculate the annual equivalent of the gain. The annual equivalent is calculated by dividing the gain by N (see earlier).

Step 4: Calculate the individual’s liability to tax on the annual equivalent. For gains arising on or after 11 March 2020, the personal allowance is recalculated where appropriate. The amount of the savings starting rate and personal savings ‘allowance’ used in the top slicing relief calculation are set by virtue of the taxpayer’s adjusted net income for the tax year. They are not adjusted to calculate the notional tax due on the ‘sliced gain’. Deduct basic rate tax treated as paid* on the annual equivalent and multiply the result by N. This gives the individual’s relieved liability

Step 5: Deduct the individual’s relieved liability at step 4 from the individual’s liability at step 2 to give the amount of top slicing relief due.

*Note: Basic rate tax is also deducted for offshore bonds for the purposes of the top slicing calculation.

There is a worked example for both onshore and offshore bonds later in this article.

When part of the gain falls into additional rate

Top slicing relief is not just available to mitigate a higher rate liability arising on a chargeable event gain but is also available to mitigate an additional rate liability. In 2022/23, individuals with adjusted net income in excess of £150,000 are subject to additional rate tax of 45% on the excess (39.35% dividend additional rate).

There is a worked example where part of the gain falls into additional rate later in this article.

Two or more chargeable event gains the same tax year

In this case, the total gains are added together. The ‘annual equivalent’ is calculated separately for each gain, and then these annual equivalents are added together.

Example

£12,000 gain on Bond A arisen over four years. Annual equivalent = £3,000

£30,000 gain on Bond B arisen over six years. Annual equivalent = £5,000

Total gains = £12,000+£30,000 = £42,000.

Total annual equivalent = £3,000+£5,000 = £8,000.

Top slicing factor (N) = £42,000/£8,000 = 5.25 years.

When top slicing relief doesn’t apply

Top slicing relief is available to mitigate a higher rate or additional rate income tax liability arising as a result of a chargeable event gain being added to the taxpayer’s total income. It does not:

• Reduce income for the purposes of child or working tax credits (instead the full amount of the gain is included).

• Reduce income below £100,000 to preserve full entitlement to the personal allowance.

• Apply to personal representatives, corporate’s or trustees. However, for the avoidance of doubt where a gain arises on a trust held policy and the creator is chargeable then that person would be eligible for top slicing relief. In contrast, where the creator is deceased or non resident and the trustees are non resident then a UK beneficiary receiving a benefit from the trust is taxable on that amount – if so, top slicing relief is not available.

• Apply to annual gains that arise on ‘personal portfolio bond events.’

Self Assessment

HMRC Helpsheets 320 and 321 help investors fill in the relevant boxes in their tax return for gains on UK life insurance policies and foreign life insurance policies respectively. The Helpsheets are available from HMRC: HMRC Helpsheets 320 and HMRC Helpsheets 321

Gains on UK policies are inserted into the ‘Additional information’ pages of the tax return. The full amount of the gain should be returned together with the number of complete years. This information is available from the chargeable event certificate issued by the insurer. If the individual is due any top slicing relief it will then be automatically calculated using the information provided.

Gains on foreign policies are inserted into the ‘Foreign’ pages of the tax return. A chargeable event certificate might not be available showing the gain if the policy was taken out before 6 April 2000, and for later policies the reporting requirements are not as onerous as those for UK policies. Nevertheless it remains the responsibility of the investor to report gains under self assessment principles.

HMRC – Insurance Policyholder Taxation Manual

HMRC – Self assessment guidance

Example of top slicing relief for an onshore bond

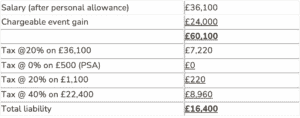

Anne has a taxable salary in tax year 2022-2023 of £36,100 (after personal allowances) and a chargeable event gain of £24,000 on the surrender of an investment bond that she had held for just over eight years. The basic rate band for 2022-23 is £37,700.

Her tax liability for 2022-23 before top-slicing relief is

Calculation of Relief

Step one

Anne’s taxable income (including the chargeable event gain) is £60,100. The gain falls within the different tax bands as follows:

PSA – £500 @ 0%

Basic Rate Band – £1,100 @ 20%

Higher Rate Band – £22,400 @ 40%

Step two

The total tax due on the bond gain across all tax bands is £9,180

The tax treated as paid on the gain is £24,000 @ 20% = £4,800

The individual’s liability for the tax year is therefore £9,180 – £4,800 = £4,380

Step three

The ‘annual equivalent’ of the gain £24,000 / 8 = £3,000.

Step four

The ‘annual equivalent’ + taxable income = £3,000 + £36,100 = £39,100.

The total tax on the slice is (£500 @ 0%) + (£1,100 @ 20%) + (£1,400 @ 40%) = £780

The tax treated as paid on the slice is £3,000 @ 20% = £600

The individual’s tax relieved liability is (£780 – £600) multiplied by “N”. In this “N” case is 8 years so the tax relieved liability is £1,440

Step five

Top slicing relief = £4,380 – £1,440 = £2,940

Summary

Anne’s liability after top-slicing relief is £16,400 – £2,940 = £13,460

The basic rate credit is £24,000 @ 20% = £4,800.

The overall liability is reduced to £13,460 – £4,800 = £8,660

Example of top slicing relief for an offshore bond

If we took the last example of Anne, but instead the bond had been offshore, the above five steps would be identical.

Anne’s liability after top slicing relief would be £16,400 – £2,940 = £13,460

There is no reduction in her liability since no basic rate credit is due for an offshore bond.

Example of top slicing relief for an onshore bond with additional rate tax due

Bridgit has a taxable salary in tax year 2022-2023 of £32,700 and a chargeable event gain of £160,000 on the surrender of an onshore bond on 1 June 2021 that she had held for just over eight years.

Her total income is greater than £100,000 so the basic personal allowance is reduced to zero, but reinstated at Step 4.

Her tax liability for 2022-23 before top-slicing relief is:

Calculation of Relief

Step one

Bridgit’s taxable income (including the chargeable event gain) is £192,700. The gain falls within the different tax bands as follows:

Basic Rate Band – £5,000 @ 20%

Higher Rate Band – £112,300 @ 40%

Additional Rate Band – £42,700 @ 45%

Step two

The total tax due on the bond gain across all tax bands is £65,135

The tax treated as paid on the gain is £160,000 x 20% = £32,000

The individual’s liability for the tax year is therefore £65,135 – £32,000 = £33,135

Step three

The ‘annual equivalent’ of the gain £160,000 / 8 = £20,000

Step four

In this step, we add Bridgit’s salary of £32,700 to the £20,000 slice to give us a notional adjusted income of £52,700. As this figure is below £100,000 the full personal allowance will be reinstated, in this step only. As detailed later in the article, her personal allowance must be set against her salary in preference to the gain.

With regard to the salary, £12,570 is taxed at 0% within the personal allowance. The balance of £20,130 is taxed at 20%. The bond slice of £20,000 will then be taxed as follows.

The total tax on the slice is (£17,570 @ 20%) + (£2,430 @ 40%) = £4,486

The tax treated as paid on the slice is £20,000 @ 20% = £4,000

The individual’s relieved liability is (£4,486 – £4,000) multiplied by “N”. In this “N” case is 8 years so the tax relieved liability is £3,888.

Step five

Top slicing relief = £33,135 – £3,888 = £29,247

(The first part of thugs article can be found HERE. The third part of this article covers FA 2020 top slicing measures.)