Professional Paraplanner’s TDQ (Training, Development and Qualifications) series, is run in conjunction with key support providers, such as Brand Financial Training, and aims to test your knowledge of the financial services market, as part of your overall training goals and exam techniques.

The following questions, which can also be found in our November 2020 issue, relate to examinable Tax year 20/21, examinable by the CII until 31 August 2021.

10 QUESTIONS

1. Which of the following statements regarding ‘structured’ and ‘unstructured’ loans is incorrect?

A. Structured loans are viewed as lower risk than unstructured

B. Unstructured loans tend to be for larger amounts

C. The interest rate applied on an unstructured loan is usually linked to a base rate

D. There is often no collateral to back up a structured loan

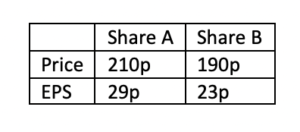

2. These two company shares sit in the same sector.

From the information given we can make the general comment that:

A. share A is overpriced.

B. share B is under-priced.

C. share A will provide better returns than B.

D. share B is expected to grow more than Share A.

3. Stan has taken out a partial home reversion plan. What will be the position on Stan’s death?

A. The entire property will not form part of Stan’s estate on his death.

B. On Stan’s death, the loan in respect of the part of the property in the plan will need to be repaid.

C. The part of the property retained by Stan will form part of his estate.

D. Property will revert in full to the plan provider.

4. John’s pension fund is invested in with profits. John should be aware that: Tick all that apply.

A. a terminal bonus is guaranteed to be paid on crystallisation or earlier death.

B. once added, reversionary bonuses cannot be taken away.

C. the fund will only invest in cautious/low risk investment areas.

D. annual bonuses are aimed at “smoothing” returns over the term.

5. Susan has a mortgage payment protection insurance policy. If she makes a claim on becoming unemployed, the very maximum amount of time for which benefits will be paid is usually:

A. 9 months

B. 12 months

C. 18 months

D. 24 months

6. If the Stock market rises by 4% which of the following shares is most likely to rise by more than 4%?

A. Share A

B. Share B

C. Share C

D. Share D

7. What is the fundamental difference between bearer shares and registered shares?

A. There is no name on a bearer share certificate.

B. A bearer share certificate is held in a central vault.

C. The share certificate is dispensed with altogether.

D. A depository takes custody of the bearer share certificate.

8. Simon makes payments to his occupational pension scheme by deduction from his pay. What is this method known as?

A. Net pay arrangement

B. Relief at source

C. Gross pay arrangement

D. Relief by claim

9. Caroline has recently made a profit on the sale of her buy-to-let property. She now owes HMRC capital gains tax of £6,000. The sale completed on 1 September 2020. She will therefore need to pay this tax by:

A. 30 September 2020.

B. 31st January 2021.

C. 5th April 2021.

D. 6th April 2021.

10. Which Act makes local authorities responsible for promoting individual wellbeing?

A. Health and Social Care Act 2001

B. Care Standards Act 2000

C. Mental Health Act 2007

D. Care Act 2014