In any crisis, it is easy to lose sight of the big picture while grappling with the near-term impact. Fidelity Emerging Asia Fund portfolio manager Dhananjay Phadnis discusses how Asian companies are reacting to the unique set of challenges created by Covid-19 and outlines why a focus on sustainability can successfully identify the region’s long-term winners.

The Covid-19 crisis has provided Asian companies with a unique opportunity to look beyond the narrow focus of how to meet this year’s financial targets. As a long-term investor, I’ve been encouraged that an increasing number of companies are clearly using this crisis as an opportunity to protect and enhance the long-term value of their businesses. This is in sharp contrast to the market’s traditional focus on short-term earnings.

Author Alex Edmans, in his book titled ‘Grow the Pie: How Great Companies Deliver Both Purpose and Profits’, argued that companies that adopt a pie-growing mindset – aiming to improve value for all stakeholders rather than putting one ahead at the expense of the other – will be the companies that can deliver sustained value creation.

In that sense, while it may seem like shareholders have been at the receiving end of the crisis-related pain through earnings cuts, lower dividends and reduced share buybacks, the reality could be that many companies will be able to enhance stakeholder value by cushioning the impact for at least some of them during this crisis.

Mapping the transformation on-the-ground

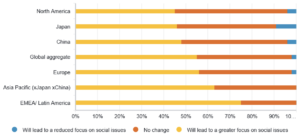

We have been able to map this transformation of corporate purpose through a post-crisis survey of more than 140 of our analysts worldwide. Over half of the responses indicated an increase in company plans to step up focus on workers, consumers and the wider community as a result of the pandemic. Notably, for our analysts based in Asia this figure was over 60%.

Fidelity Analyst Survey – how will the Covid-19 crisis affect your companies’ approach to social issues?

Source: Fidelity International, May 2020. Note: The survey was conducted between 6-11 May and featured 205 responses from 145 analysts around the globe (analysts who cover more than one sector or region take the survey more than once).

At a company level, we’ve seen several examples of this long-term approach over recent months:

China Mengniu

Leading Chinese dairy products producer China Mengniu kept its commitment to buy milk from dairy farms and honoured its procurement obligations through the crisis. It even provided zero-interest

funding to help farms with temporary liquidity pressure. Not only will this help farmers survive, but it will also help save a lot of raw milk from going to waste.

China Mengniu plans to convert this raw milk to milk powder to store up as inventory for future use. While this will affect the margins in the near-term, it will protect the supply chain and enhance the sustainability of their business over the long-term.

Banks

Banks have been in the eye of the storm given many of their borrowers have seen a significant disruption to cash flows. In Indonesia and India, the government and central bank moved to offer assistance to help banks extend credit to borrowers via interest rate subsidies or loan guarantees. Several banks such as Bank Rakyat in Indonesia have been proactively restructuring loans, while in India the central bank has ensured loan moratoriums for several types of borrowers.

This will almost certainly hurt near-term earnings via margin compression and potentially increase credit costs and non-performing loans. However, by helping their borrowers survive and by enhancing customer loyalty during difficult times, many of these well-capitalised banks will likely see their long-term value rise.

Sportswear

Chinese sportswear companies Anta and Li Ning implemented a series of initiatives, including buying back inventory from distributors, providing subsidies, cutting/delaying future shipments and extending credit terms to save distributors from a severe profit and liquidity squeeze. But more importantly, it protects the brands from excessive discounting thereby sustaining the franchise value over the long-term.

Healthcare

One of the significant benefits of purpose-driven companies is that they attract motivated talent. A great example is Indian pharma company Cipla which embeds affordable drugs in its mission and has consistently demonstrated its care for lower income groups. Cipla’s employees voluntarily contributed US$400,000 to add to the company’s own virus- related donations. Companies that will make a genuine effort to help the community should benefit from a motivated and purpose-aligned workforce.

Five questions for sustaining long-term returns

As we move beyond Covid-19 and the near-term winners and losers, the challenge for investors is to maintain longer-term view and assess the extent to which the future prospects for individual stocks and sectors is already priced into markets. To do this, one must consider the following five questions:

1. Will current behavioural patterns persist a year from now?

Will people continue to devote as much time to playing online games? Will as many people still want to work from home? The answer probably lies somewhere between the pre-Covid and mid-Covid levels of activity.

2. Will the short-term earnings hit actually lead to an increase in long term value of a business?

Are the company’s actions leading to higher operational robustness and improved customer and employee loyalty? In the examples of Mengniu, Anta and many of the banks, we saw that they are investing in the sustainable growth of their businesses via cushioning the near-term impact for their stakeholders. As a result, these businesses will have made their business models even more sustainable in the long-term.

3. What does the business structure look like in the medium to longer-term?

Most large companies have done the right thing by postponing any staff-related cost rationalisation in the midst of this crisis. But what happens once the dust settles? Companies, big and small, will need to review their operating models. In some cases, this will mean a faster move towards automation (driven by hygiene as well as cost imperatives), while in the case of others this will mean jettisoning parts of the portfolio to protect the core.

4. What is the real earnings power of a business?

We have seen many companies boost earnings per share (EPS) through a massive levering up of the balance sheet with low cost debt to pursue buybacks and thereby enhancing the company’s EPS growth rates. Many others have also reduced the level of investments, helping their stock valuations. Going forward, the market is likely to place a discount on this form of earnings enhancement which makes the business less sustainable by taking on excessive debt or by risking their future due to under-investment.

5. What is the level of government interference in the business going forward?

Governments across the world have pulled out all the stops to protect their economies during this crisis via a combination of fiscal and monetary measures. As and when the intensity of this crisis reduces, several sectors will be at risk from government intervention. For instance: state-owned banks may be forced to forgive loans, while drug companies could come under pressure to make their drugs more affordable. It is also likely we see higher tax levels for several sectors and groups of citizens which could alter the long-term value of the business.

Summary

Differentiating between the trends that will persist and those that fade offers investors the potential for a significant differential in future investment outcomes. By keeping our focus on sustainability and extending our investment horizon, we believe we can identify companies that can create long-term value for both their shareholders and stakeholders.

Learn more about Fidelity’s Asia expertise and investment strategies HERE.

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of an investment in overseas markets. Investments in small and emerging markets can also be more volatile than other more developed markets. Reference in this article to specific securities should not be interpreted as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. The Fidelity Emerging Asia Fund can use financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The fund has the potential of having high volatility either due to its composition or portfolio management techniques. Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document, current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority and Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0820/26817/SSO/NA