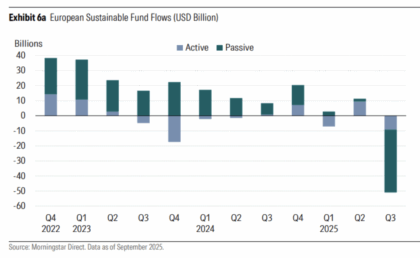

Global sustainable open-end and exchange-traded funds registered net outflows of about USD 55 billion in the third quarter of 2025, Morningstar’s latest research Global Sustainable Fund Flows: Q3 2025 shows.

The vast majority of the outflows stemmed from redemptions in a range of UK-domiciled BlackRock funds, following a client pension fund’s decision to transfer assets into custom ESG mandates managed by BlackRock.

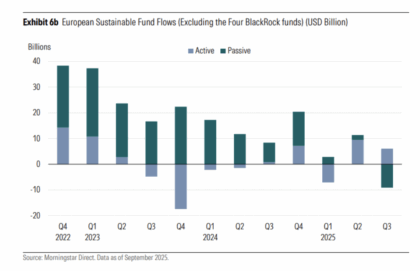

However, excluding these BlackRock funds, global sustainable funds still recorded estimated outflows of USD 7.2 billion in the third quarter, compared with restated inflows of USD 6.2 billion in the previous quarter.

Key take aways of the research were as follows:

• Excluding the BlackRock funds, European sustainable funds faced net redemptions of USD 3.1 billion in the third quarter, a notable reversal from the inflows of USD 11.3 billion seen in the previous quarter.

• Sustainable funds in the United States continued to experience net outflows for the 12th consecutive quarter, though the total was slightly lower, at USD 5.1 billion, in the third quarter.

• The rest of the world, in aggregate, attracted over USD 1 billion.

• Fixed income stood out as the only asset class gathering new money, with net subscriptions of about USD 12.5 billion, globally.

• Global sustainable fund assets rose by about 4% in the third quarter to USD 3.7 trillion, supported by stock market appreciation.

• Product development remained subdued, with only 26 new sustainable funds launched globally over the quarter.

Commenting on the findings, Hortense Bioy, head of sustainable investing research at Morningstar Sustainalytics, said: “The large headline outflows from global ESG funds mask a more nuanced story. Amid macroeconomic uncertainty, geopolitical volatility, and policy shifts, we are seeing significant reallocations, with large sums moving between strategies within asset management firms and into customized institutional mandates.

He added that they expected investor appetite for ESG funds “will continue to be tested by the ongoing ESG backlash and an evolving regulatory landscape.”

The full report can be found HERE>

Main image: richard-r-schunemann-3QsFMZLm_KU-unsplash