Structured products have experienced “another great year for the sector”, according to the latest data from Lowes Financial Management.

Lowes, which has been f analysing and investing in structured products for over 20 years, publishes its Structured Products Annual Performance Review every January. This provides an overview of the retail structured product maturities of the past year.

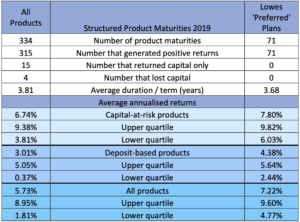

The analysis revealed that 334 plans matured in 2019, of which 80 were structured deposits. 94.31% of maturing products produced positive results, while just four maturities gave rise to a loss – the first time the sector had witnessed a loss since May 2017.

Capital-at-risk maturities returned an average of 6.74% last year, with the best performing quartile delivering average returns of 9.38% and the lower 25% returning 3.81% per annum. Deposit-based maturities returned 3.01% per year, the firm added.

To compile the Review, Lowes monitors every new launch throughout its lifespan and each January produces the Structured Products Annual Performance Review an analysis of all plans distributed via UK financial advisers, which matured during the previous year.

Ian Lowes, managing director, Lowes Financial Management, said: “Whilst markets in 2019 proved tricky to navigate and at the year end the FTSE 100 index was at approximately the same level it was at two years earlier, it was yet another successful year for structured products.

“Structured products are designed to perform exactly in line with the defined terms stated at outset and unfortunately this meant we saw the first structured products to mature with a loss since May 2017. These were higher-risk, share-linked plans (which were not ‘Preferred’ by Lowes) and they suffered as a result of the significant decline in the value of one of the shares to which returns were linked.

“Despite the continued success of the sector for many years it is still an investment area overlooked by many. Structured products have been quietly delivering great results year in, year out for advisers and their clients – and they achieve these returns whilst protecting original investment capital from all but the most extreme events.”

As part of its annual review, Lowes analyses every new product launched, identifying which new offers it “prefers.” The 71 plans which Lowes “preferred” in 2019 delivered an average annualised return of 7.22% over an average term of 3.68 years, it said.

In addition, the Lowes UK Defined Strategy Fund, launched in December 2018, returned 5.12% over the year.

Lowes added: “The evidence proving the success of these investments is now overwhelming and has led to more advisers turning to structures to form a part of their client proposition.”

The Review can be downloaded from the Lowes website at:

Structured Products Maturities 2019 – highlights