Our recent parameters survey on the understanding and application of Consumer Duty revealed a degree of uncertainty amongst paraplanners about the exact requirements of the new rules.

Paraplanners reported that the majority of their firms have had to change the way they operate as a result of the Consumer Duty, according to Professional Paraplanner’s recent Parameters Survey.

The findings revealed that six months on from the introduction of the new regulation, nearly nine in 10 firms (88%) have changed the way they work. Nearly half (49%) of those surveyed said the requirements had forced “very marginal” changes, while 32% said “moderate” change was necessary. One in 14 firms (7%) said the requirements had prompted them to make “significant” changes.

In contrast, just 10% of paraplanners said their firms had not had to especially change their policies or procedures in response to the new requirements.

Paraplanners said changes had included having to update suitability and research practices, update policies and amend charging structures.

One respondent said: “We have updated out client vulnerability policy and made better use of technology to ensure we are delivering an improved and user-friendly client experience.”

While a large number of firms already adhered to many of the principles of Consumer Duty before the regulation was introduced, a significant number have had to make tweaks to ensure everything is clearly documented.

One respondent said: “Our firm was already following many of the principles laid out by Consumer Duty but we have now looked at additional steps we can take to ensure we are on the front foot with this and the service we provide to our clients aligns with the fundamental ideas of Consumer Duty. Showing each client clearly what value we offer them and clearly outlining our advice and value.”

Another respondent said the documentation side had “resulted in us looking at our current processes and ensuring that we are all following the same structure.”

Uncertainty over the exact requirements

But despite Consumer Duty having a widespread impact on firms’ activities and the way they operate, the survey also revealed ongoing uncertainty around the exact requirements of the regulation.

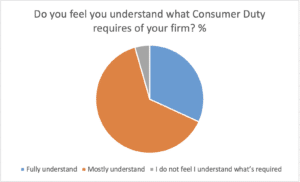

Only around a third (32%) of paraplanners said they “fully understand” the requirements placed upon them. In contrast, double the figure (64%) said they “mostly understand” but 4% admitted they do not understand what is required.

Question marks were raised over the terminology used by the Financial Conduct Authority, with respondents noting that terms such as “fair value” can be ambiguous.

One said: “There are so many webinars and sessions about it but I really don’t feel like much has changed so I don’t get what the “extra” requirements are. I am sure we are adhering to the requirements but as there has been no real change to me, I don’t feel I really understand what is required.”

The findings of the survey suggested that without clear instructions on how to approach particular tasks, for example demonstrating value, the requirements are open to interpretation.

Advice firms also have had different approaches to informing paraplanners about the Consumer Duty rules. Internal training appears to be the most popular method, with 30% of respondents stating they had learnt about the rules through training.

Just over a fifth (22%) said their understanding had come from a mix of internal training and self-learning/ team effort, while 20% had embarked on a mix of internal and external training as well as self-learning. A further 13% of those surveyed said they had relied on external training and self-learning and 6% said they had learnt about Consumer Duty from their paraplanner team, while 5% were solely self-taught.

Client impact

While the impact of Consumer Duty on firms is clear, respondents were divided on whether the rules have had an effect on clients.

Some firms told Professional Paraplanner that the new regulation had led to cheaper solutions, better protection and service and greater peace of mind for clients.

“The implementation can only have a positive impact on clients going forward,” said one respondent. “This will ensure that fair value and treating customers fairly is well documented and there will be a full audit trail to evidence to the client that we have regularly reviewed and assessed their circumstances and ongoing arrangements.”

Another said: “We have reviewed our service proposition to ensure the level of service clients receive is suited to the size of their investments. For some clients, this has meant that we have offered to scope back our services in order to ensure that one client’s fees aren’t being used to subsidise the fees for a client with a smaller portfolio.”

However, others said changes would be so small and subtle that it would have little impact on clients.

One added: “In essence nothing has affected our clients which reflects the fact we always thought our proposition provided fair value in the first place. It was more internal processes or documents that needed tweaking.”