The number of over-55s relying on property wealth to fund later-life care is on the rise, according to equity release specialist Key.

According to its new report Tackling the Care Question, nearly three in ten (29%) over-55s plan to use their homes to fund care, compared with just 19% a year ago.

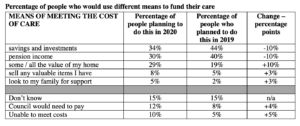

In contrast, those expecting to use their savings and investments has dropped to 34% this year from 44% in 2019, while those planning to use pension income also fell to 30% from 40% over the same period.

The study by Key also revealed an overwhelming desire among people to receive care in their own homes, with three quarters (75%) of over-55s planning to either stay in their current home or move to a more manageable property. Yet, a quarter of people either don’t know how they would meet the cost of care (15%) or wouldn’t be able to meet the costs (10%.)

Despite this uncertainty, financial assistance from the Government has decreased over the past year. Figures showed that the number of people receiving some sort of financial support for care from councils in England, Wales and Scotland dropped 10% year-on-year from 568,867 in 2017/18 to 512,816 in 2019/20.

Will Hale, CEO, Key, said: “When you speak to people, you find that the vast majority are keen to receive care and support in the comfort of their own home but struggle to know how, or how best, they might meet these costs. With the recent economic turmoil, confidence in savings and pension income has fallen while more people are looking to the value tied up in bricks and mortar to finance care. Getting good advice and understanding what resources you have to draw on is important – and making sure you factor these potential costs into your retirement planning is vital.”