Continuing his market megatrends series for Professional Paraplanner, Lawrence Cook, head of UK Intermediary Distribution at Sanlam UK, presents the group’s views on the reinvention of the UK property sector.

Our world, and the way we live, continues to evolve. These changes are being driven not only by long-term structural developments – technological innovation, demographic changes, and an increasingly urbanised population – but also by the unforeseen impact of the Covid-19 pandemic. And these changes are influencing the buildings around us: from shops and offices to retirement and student accommodation and warehouses, the weight of demand is transferring from traditional property investments towards areas of future growth.

Our world, and the way we live, continues to evolve. These changes are being driven not only by long-term structural developments – technological innovation, demographic changes, and an increasingly urbanised population – but also by the unforeseen impact of the Covid-19 pandemic. And these changes are influencing the buildings around us: from shops and offices to retirement and student accommodation and warehouses, the weight of demand is transferring from traditional property investments towards areas of future growth.

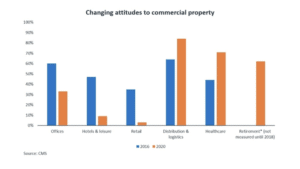

As lockdowns and social distancing measures took effect in 2020, sentiment towards sectors that involve physical proximity – offices, hotels, shopping malls and gyms – deteriorated, while sentiment towards sectors that involve less physical proximity – data centres, self-storage facilities, and spaces supporting online shopping, food delivery, and healthcare – continued to strengthen.

The Covid-19 pandemic exacerbated a swing towards home working. Many businesses have found themselves compelled to re-examine their business model, raising questions over the future of the traditional office building.

“There is no denying that the Covid-19 pandemic has changed some ways of working and accelerated some positive trends that were evident already in urban centres” Alastair Moss, Planning and Transportation Chair at the City of London Corporation

The attractions of traditional commercial property sectors – such as offices, hotels & leisure, and retail – dropped significantly during the pandemic, whereas specialist sectors – including distribution & logistics, healthcare, and retirement property – rose sharply.

In a report produced by CMS – “Real Estate Re-set: offices and purpose beyond the pandemic” – 1,500 senior office occupiers across the UK, Europe and Asia rated various asset classes on their appeal, and attitudes between 2016 and 2020 showed a marked change.

Although recent events have raised question-marks over the outlook for the commercial property sector, it is worth taking a closer look at some of the specialist areas within the sector that demonstrate clear prospects for strong long-term growth: retirement housing; student accommodation; and warehousing.

An expanding retirement sector

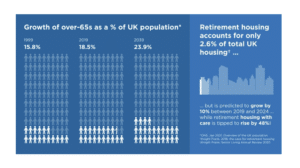

The UK population aged 65+ years is growing faster than all other age groups. Although this increase is expected to drive demand for retirement accommodation. Total housing stock for senior citizens is forecast to grow from 658,000 to more than 800,000 by 2024, but this rate of delivery is set to be eclipsed by the UK’s rapidly ageing population. The Office for National Statistics (ONS) predicts that the number of over-65s will rise by 7.5 million to reach 19.8 million by 2069, representing 26.2% of the UK’s projected population.

Moreover, the Elderly Accommodation Counsel (EAC)[1] reported over half of the UK’s purpose-built retirement units were built or renovated more than 30 years ago, suggesting significant scope for expansion and overhaul within the sector. With demand for specialist retirement accommodation set to rise over coming years, Retirement Villages Group (RVG)[2] recently unveiled plans to build over 5,000 new homes over the next ten years on urban sites, including the redevelopment of offices, shops and a car park on a site in Surrey.

Demographics driving demand for student accommodation

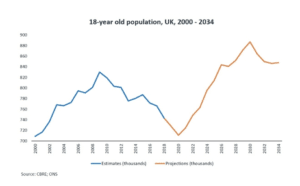

Purpose-built student accommodation (PBSA) is another specialist area that is attracting interest. Demand for PBSA is expected to continue to grow, underpinned by a rising proportion of international students. International student numbers rose almost ten times faster than domestic student numbers between 2017/18 and 2018/19, according to Savill’s Spotlight on UK Student Accommodation. Non-EU applications for undergraduate courses at UK institutions increased by 10% between 2019 and 2020, and applications from China climbed by 24%. Students from overseas are 60% more likely to live in PBSA than domestic UK students, and demand from international students is projected to rise from five million to eight million by 2025[3].

The need for additional PBSA is also likely to be driven from within the UK: although the UK’s population of 18-year-olds has been falling since 2009, it is predicted to rise from 2021.

Although there is insufficient supply of PBSA at present, UK student accommodation remains attractive to overseas investors; of the £17 billion[4] invested in PBSA in the UK between 2016 and 2019, 58% originated overseas.

The rise and rise of online retail

While technological advances have increased the ease and accessibility of online shopping, Covid-19 created a sharp rise in demand. At the same time, the pandemic highlighted flaws in the existing “just-in-time” business models. Shortages caused by disruption to supply chains have spurred retailers to reappraise their business models and shift to a more flexible “just-in-case” approach to handle unexpected fluctuations in demand.

In turn, higher stock levels are fuelling interest in more local warehousing. As businesses reassess their approach to warehousing and inventory and seek to automate their operations, warehouse specifications – from power supply to car parking – are likely to become increasingly tailored towards their role in the supply chain.

CBRE’s European Logistics Occupier Survey[5] found that, while 40% of all respondents said expansion in urban locations is a high priority, this proportion rose to 50% for food retailers, and 64% for online retailers. In particular, online retailers have become more focused on the “last mile” in the delivery process. Retailers are seeking to develop and protect market share by providing nimble, timely delivery, and this is likely to stoke demand for smaller warehouses and fulfilment centres that are positioned closer to the end customer. Meanwhile, an increasing number of retailers are following restaurants by experimenting with “dark” stores – locations that operate purely as fulfilment centres – to facilitate faster, more efficient delivery.

As online retail continues to grow, the need for large physical shops looks set to diminish over time. Although this presents retailers with a significant challenge in the short-to-medium term, it also creates opportunities for proprietors and developers. Surplus retail space can be regenerated, perhaps moving towards innovative mixed-use schemes encompassing retail, office space, residential and leisure facilities, reflecting the changing ways in which we live, work, shop and socialise. The City of London Corporation[6] recently announced plans to repurpose vacant space within the Square Mile, including the addition of 1,500 new homes by 2030.

Building on change

Although the Covid-19 pandemic has raised questions over the outlook for traditional commercial property plays such as shops and offices, it has also accelerated the development of fresh opportunities across the sector, underpinned by long-term social, demographic, and technological change. As people’s behaviour and habits continue to evolve, companies, developers and investors are taking a fresh look at real estate.

Through its exposure to real assets, Sanlam Multi-Strategy Fund takes advantage of the long-term attractions of specialist property subsectors that are positioned to benefit from lasting growth in demand.

[1] Savills, 20 June 2019

https://www.savills.co.uk/research_articles/229130/283708-0

[2] RVG, 15 Apr 2021

[3] Savills, 7 Apr 2020

[4] Savills, 23 Sept 2020

Savills | Spotlight on UK Student Accommodation

[5] CBRE, 3 Nov 2020

UK Urban Logistics: Delivering Closer to Consumers October 2020 | CBRE

[6] City of London Corporation, 27 Apr 2021

[Main image: shivendu-shukla-3yoTPuYR9ZY-unsplash]