With some careful timing, there are ways to make to the most of tax wrappers for children. Martin Jones, technical manager at AJ Bell, explains.

While many clients will have tightened their belts over the least year or so, there is a significant group who will find themselves with surplus cash given that typical spending activities have been largely restricted during lockdown.

These clients might look at this as an opportunity to fund their own pensions and ISAs. But the area I want to focus on here are the tax wrapper opportunities available for their children, particularly with regard to ISAs.

If you bear in mind that children’s investments potentially have a very long-term investment horizon, there is a lot of tax-free compound growth to be had, and this could be boosted by some early ‘over-funding’.

Child Trust Funds and Junior ISAs – triple funding

The first opportunity relates to Child Trust Funds (CTFs). These are tax-free savings accounts that were open to children born between 1 September 2002 and 2 January 2011. Eligible children received an initial payment from the government of £250, which was paid direct to the CTF.

CTFs never really captured the public’s imagination in the way it was hoped, and they were effectively replaced by Junior ISAs (JISAs), which many viewed as being more flexible.

However, there are still millions of CTFs in existence, and while it’s no longer possible to open a new CTF it’s still possible to pay into an existing CTF given they have their own annual tax-free allowance (£9,000 in 2021/22).

And thanks to a rule change in 2015, clients can transfer their CTFs to JISAs.

Therefore, even if your client has paid nothing into the CTF since the initial £250, it offers a nice opportunity to squirrel funds away tax-free and then roll them into a JISA.

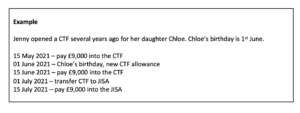

They key technical point to know here is that the allowance period for CTFs runs in line with the child’s birthday rather than the tax year. This means it’s possible to put away three tax-free allowances in a short space of time.

A couple of pitfalls to note, however.

It’s not possible for a child to hold a CTF and JISA at the same time, so the CTF funding must happen before the transfer to the JISA. (If it were to happen after, the JISA would be declared void and funds returned.)

The registered contact (i.e. the parent responsible for the account) must be the same person on the CTF and the JISA otherwise the transfer cannot go through.

It is possible to change the registered contact without much difficulty, but clients will need to get their ducks in a row before executing the strategy.

Junior ISA to Adult ISA transition – dual allowances

In September 2020, we saw the first CTFs come to maturity as the first cohort of CTF children turned 18. Many of these CTFs will be transferred into adult ISAs and will continue to grow tax-free.

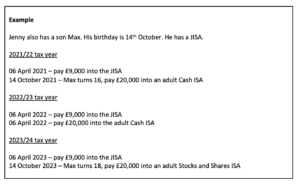

The opportunity I want to talk about here though relates to JISAs and to children in the 16-18 age bracket.

The minimum age to open an adult Stocks and Shares ISA is 18. But from the age of 16, children can open an adult Cash ISA, for which they have the full adult ISA allowance of £20,000 available to them.

They also still have the full JISA allowance of £9,000 too given that the two accounts are separate tax wrappers. The £9,000 does not reduce the adult allowance in any way. Money can be paid into both accounts in the same tax year.

Over three years, Jenny has paid £87,000 into Max’s ISAs – all tax-free – which is a lot more than Jenny could have paid into her own ISAs over the same period.

Max’s JISA converts to an adult ISA at age 18. Rather than maintain three accounts, he transfers the converted JISA and the Cash ISA into his Stocks and Shares ISA, which continues to grow tax-free.