Tom Dobell manager of the industry’s oldest unit trust, the £1.4 billion M&G Recovery fund has stepped down from his fund management responsibilities and will leave M&G at the end of December.

Michael Stiasny will take over the management of the M&G Recovery Fund from Dobell at that time.

Stiasny has a 20-year career at M&G, during which he has headed the equity research team and has managed funds including Charifund, the M&G UK Income Distribution Fund and the M&G Dividend Fund. He will continue to manage his existing funds alongside the M&G Recovery Fund. M&G will be looking to make a senior hire to support Michael.

M&G said the change is part of an ongoing review of M&G’s mutual fund range. The asset manager added that while there will be “no change to the fund’s investment objective and policy”, there would be “a refreshed investment approach for the fund, with an increased focus on the unloved midsized companies which have contributed most to value creation over the fund’s lifetime and the valuation opportunities so often found when companies are going through difficulty.”

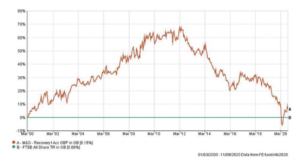

Dobell joined M&G in 1992 as a UK equity manager on the segregated pension fund desk, becoming fund manager of the M&G Recovery Fund in March 2000. Over the period to 11 September 2020 the fund has delivered a 127.7% cumulative return after fees, compared to the FTSE All Share return of 118.4%, ranking the fund in the second quartile of its IA sector.

Commenting on the change, Adrian Lowcock, head of personal investing at investment platform Willis Owen, said: “Tom Dobell’s mammoth fund has been underperforming for years as recovery investing has been out of favour for a long time. His resignation will be tough as Tom has diligently executed the funds process and philosophy. However a change in management makes sense to take the fund forward in a changing world, where recovery investing may need a fresh perspective as we move through the pandemic.

Ryan Hughes, head of active portfolios at AJ Bell, concurred, saying the change of manager was “important news to the many investors who have stuck with the fund despite its poor performance over a number of years.

“Tom delivered some fantastic performance for investors when his value style was in favour and the fund grew to be one of the largest UK equity funds at the time. However, as investors moved away from value and towards growth, performance really struggled, a fact perfectly illustrated by the performance chart which shows performance relative to the FTSE All Share during his tenure. Dobell admitted himself that the fund became too large and had too many stocks in a rare moment of contrition from a fund manager.

Darius McDermott, managing director of Chelsea Financial Services, said that investors would now have to consider carefully whether they continue with the fund under the new manager. “While there will be no change to the investment process… it continues to be a challenging time for recovery investors and mid-caps in particular could feel the brunt of any Brexit bad news in the short term. But over the long term, I am still of the belief that the price you pay for shares in a company has an impact on future returns. Some investors may like to give the new manager the benefit of the doubt and see how he progresses. Others may prefer to put their faith in a more experienced multi-cap recovery manager.”

Four alternative recovery funds to consider (selection and comment provided by Fund Calibre):

Schroder Recovery: This quietly aggressive, value-driven fund has been run by the same lead managers, Nick Kirrage and Kevin Murphy, since 2006, with a continuity of process and a very consistent track record. They invest in companies that have suffered a severe business or price setback, but where the managers believe long-term prospects are good.

JOHCM UK Dynamic: After more than 10 years in charge, manager Alex Saviddes has produced one of the most interesting multi-cap equity funds in the UK sector. He has a contrarian approach, looking for companies going through a period of change. He will use conviction when others are uncertain and, unusually for a fund focusing on capital growth, it produces a naturally good level of dividend yield.

Jupiter UK Special Situations: Managed with a distinct contrarian and value-based approach, this fund offers investors access to a well-diversified portfolio. Ben Whitmore is hugely experienced and has had considerable success running this type of mandate throughout his career. He follows a methodical and well-defined investment philosophy, looking to buy stocks that are out-of-fashion with the market.

ES R&M UK Recovery: Manager Hugh Sergeant uses his three decades of investing experience to identify recovery stocks, where good businesses are currently experiencing below normal profit levels, which are depressing their valuations. If they have the capabilities to help themselves out of this predicament, Hugh will take them onboard. He will add to his holdings at almost fire-sale prices in volatile times and will be patient with their turnaround.