With the Topix up over 50% since the start of 2023, it would be reasonable to ask whether Japan’s resurgence has further to go. In the decade or so since the late Shinzo Abe announced his three arrows of economic rejuvenation, we have seen several waves of Japan enthusiasm swell up only to peter out. It seems right to question whether this time is any different, says Alex Bowles, investment analyst, Orbis Investments.

Predicting where the stockmarket will go next is not how we spend our time, nor where we have any edge. But from our bottom-up, stock-by-stock perspective, the shift in mindset we see at many Japanese companies appears to foreshadow longer-lasting changes.

Orbis have been investing in Japan for over 30 years and the Orbis Japan Equity Strategy was launched in 1998. Although this Strategy is not available in the Orbis OEIC fund suite, it is illustrative of our bottom-up approach of trying to find value in areas that others might have overlooked.

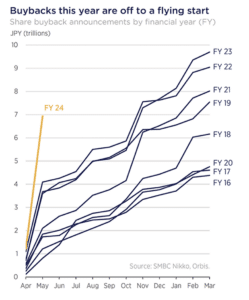

One area where we have seen a step-change has been in stock buybacks. Japanese firms notoriously amass far bigger cash piles than their Western peers, and as that cash generates negligible income, it depresses the companies’ return on equity. Buybacks let companies shed excess equity, which can mechanically improve return on the remaining outstanding equity as well as enhance their earnings per share, helping to earn a higher valuation for their stock. This makes buybacks a good tool for “self-help” as the Tokyo Stock Exchange (TSE) rachets up the pressure on firms to improve their capital efficiency.

In the past, attitudes towards buybacks were reluctant to say the least. Many management teams preferred to keep big rainy-day funds in case of emergency, while others preferred to spend on empire building or costly acquisitions. Too many still do.

But in recent years, and particularly since the TSE reforms of 2023, we are seeing attitudes slowly beginning to shift. Japanese management teams are becoming more open to engaging with investors, and more willing to take tentative steps to improve their companies’ valuations. The latest results season saw a huge jump in the value of share buybacks announced—almost double the value compared to the same time last year.

A significant chunk (just under 5% by value) of this year’s buyback announcements came from Honda Motor, a top holding in the Orbis Japan Strategy. Honda is no stranger to buybacks, having steadily reduced its share count over the past 20 years. Since mid-2022, that pace has quickened, with the company buying back 6% of shares outstanding since then and announcing a further buyback worth 3.6% of its market value this quarter.

While Honda announced one of the largest buybacks by value this year, some smaller companies have gobbled up a bigger portion of their own shares—actions that have attracted less attention from investors.

Koito Manufacturing is one such company. Koito, like Honda, operates within Japan’s gigantic automotive sector. But they don’t make the cars, they specialise in making the headlights.

While Koito is a lesser-known name, we think it’s a prime example of the opportunity we see for companies to realise their full potential through operational and capital efficiency improvements.

In late March, Koito announced its first-ever mid-term plan, and indicated how they intend to put their balance sheet to work. The plan included an aspiration to return at least ¥200bn (£980m) nearly 30% of its current market value—in shareholder returns over the next five years. This included an immediate share buyback of ¥50bn (£250m) (8% of market cap). We were encouraged by management’s boldness, and the market seemed to agree with us. On the day of the announcement, Koito’s share price shot up by 25%, its daily limit.

In early May, the company went a step further, clarifying that it actually expected to return approximately ¥350bn (£1.72bn) to shareholders over five years. At the current share price, this means Koito intends to return 50% of its market cap to shareholders in just half a decade.

Given this positive news, you would be forgiven for thinking that Koito’s valuation would now be buoyant. Not so. In 2024, Koito’s shares have lagged the rising Topix by 15%. Today the stock trades roughly at book value, and for less than 16 times estimates of this year’s earnings. That is despite the fact that Koito’s balance sheet is stuffed with cash worth 40% of its market value, and investment securities worth a further 20%.

Such a low valuation might ordinarily suggest a company whose future prospects look bleak. While we think that’s far from the truth, there may be some headwinds for Koito in the short term. Auto production in Japan has recently turned sluggish, and China—a key market for Koito—has been persistently weak. In the US, Koito has been struggling to boost margins amid higher costs, and productivity has been low amid a tight labour market. As a result, the company’s operating profit margin today is less than half what it achieved in 2018-19.

But as value-oriented investors with a long-term outlook, we try to see through the short-term fog. Over the long term, we think Koito’s future is bright.

While other car parts have become cheap and commoditised, lighting has been an attractive industry. Cars only need two headlamps, but headlamps alone account for around 60% of the value of all lights in the car. And as technology has progressed from halogen to LEDs to adaptive driving beams that adjust automatically as you drive, companies like Koito have been able to differentiate and add value. Better performance requires better technology and designs, increasing the expertise required to make Koito’s headlamps—and the prices Koito gets for them.

As a global leader in headlamps, Koito is a trusted long-term partner for carmakers seeking to stand out in design and functionality. Thanks to its advanced technology and cost competitiveness, Koito is successfully expanding beyond its core Japanese customer base, winning market share with American, Indian, and even Chinese manufacturers, including BYD. And while margins have fallen from the highs of recent years, we see ample room for them to recover. Upfront expenses tied to new customers will fade, and Koito has scope to rationalise its overseas cost structure and invest more in automation. There’s also potential for further capital efficiency enhancements down the road. While Koito has begun to address its huge cash pile, management did not address the company’s large holdings of investment securities in their mid-term plan. As management embarks on the first few steps to optimising the company’s capital structure, we see a long path ahead.

We believe Koito is a great example of the improvements underway in Japan today. But perhaps more excitingly, it is not an exceptional case. We’ve seen a wave of share buyback announcements across many companies we hold in the Orbis Japan Strategy.

In May, property developer Mitsubishi Estate revamped its capital allocation policy to include a progressive dividend and a commitment to buy back ~2.5% of shares outstanding for each of the next three years. Oil and gas producer Inpex announced a comprehensive improvement last August, which it boosted last month with a buyback worth 3% of its market cap. Life insurer T&D Holdings this quarter announced a buyback worth 4% of its market cap. Dividend payouts are also on the rise, and T&D has recently committed to unwinding cross-shareholdings (worth a sixth of its market value) by 2031.

We see similar trends across the portfolio: Japan Petroleum Exploration, Stanley Electric, Sumitomo Mitsui Trust Holdings, Sumitomo Mitsui Financial Group, Nippon Television Holdings, Suzuken, Persol Holdings, TechnoPro Holdings, Sohgo Security Services and Unipres are all buying, or have announced plans to buy back shares, and many others are ramping up their dividends.

Despite all these announcements, we believe each of these companies can afford to do much more, and what we are seeing are just the first movers of what will be a longer lasting trend. In a country that prizes consensus, we expect those companies that are yet to announce plans to improve, (of which there are plenty in Orbis Japan) will begin to feel the heat as their peers start to leave them behind.

Crucially, the opportunity to “self-help” through buybacks or increased dividend payouts is not available to all companies. While in aggregate, Japanese companies are under levered, there are many companies with significant amounts of debt. Japan remains a market ripe for active stockpickers who have the luxury of being able to identify those stocks that stand to benefit.

Main image: ryo-yoshitake-rD28m9BmXVs-unsplash