Uncertainty in the stock markets as a result of Covid-19 has driven investors to sit tight with cash, new research from Quilter has found.

According to the wealth manager, more than half (55%) of people who moved investments into cash during the pandemic would wait until markets recovered by at least 10% before reinvesting, with nearly a quarter (23%) specifically saying they would wait until markets had returned to pre-crisis levels.

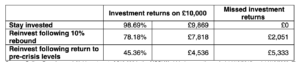

Following the dramatic stock market falls in February and March, share prices have recovered globally by more than 10%. But Quilter said if investors were to wait for the 10% rebound before reinvesting cash, they would have missed out on over £2,000 on a £10,000 portfolio invested five years ago. Waiting for a return to pre-crisis levels would have seen returns more than halved, with a difference of £5,333 in investment growth.

Source: Quilter. Based on an initial investment of £10,000 in the MSCI World Index over the period 14/10/2015 and 14/10/2020.The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into the MSCI World Index.

However, the research also found that 26% of respondents would consider reinvesting if they could time the market at its lowest.

Danny Knight, investment expert, Quilter, said the best investment strategy during times of crisis is “often to do nothing.”

He explains: “Even when markets are falling as dramatically as they did earlier this year, sticking to your financial plan and the reasons why you invested will help see your money grow over the long-term and ride out the volatility.

“Trying to time the market or waiting for markets to recover can be a dangerous game and result in a huge amount of lost growth. While cash is often considered a ‘safe’ investment, holding it for too long or in place of assets that do grow over time can result in a lot of pain.

“Even this year we saw markets rebound swiftly following the Covid-19 induced panic, and if investors were sat in cash during this period they will already have missed out on a significant part of the rebound. Instead of protecting them, selling during a falling market can lock-in losses and deprive themselves of the opportunity to capture the benefit of the recovery in asset prices. “

Knight said where possible, investors should continue to drip feed money in while markets are falling, giving them the best opportunity to take advantage of depressed share prices.