UK investors are risking potentially significant underperformance by following the growing switch to passive fixed income funds instead of taking an actively managed approach to fixed income, according to new analysis* from Rathbones Group.

The study raises concerns that retail investors may often not understand key issues with passive fixed income funds and instead focus too much on lower management costs rather than performance.

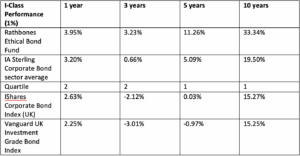

To illustrate the point, Rathbones has released data showing that its actively managed Ethical Bond Fund has out-performed fixed income holdings in well-known passive funds by more than 10% over the past five years. Over the past 10 years, growth is over a third higher in the same actively managed fund than bonds in popular passive funds, the group says.

However, Rathbones data for the whole UK market also shows active fixed income funds across all sectors saw outflows of £15.87 billion from 1 January 2022, to 31 March 2025, while passive funds achieved inflows of £14.29 billion.

The first quarter of this year has seen outflows of £1.987 billion from active fixed income funds while passive funds have achieved inflows of £878.33 million.

Despite this, gross sales for active funds were higher than for passive at £9.948 billion compared with £5.780 billion in the same period.

Bryn Jones, Head of Fixed Income, at Rathbones Group, said: “Assets under management in passive fixed income funds have held up despite there being significant underperformance in general and the significant difference in flows recently is really striking.

“Too many clients are focusing on price when they select fixed income funds, with the result that they opt for underperformance while not fully understanding the option they are taking.

“There is too little consideration given by the industry in general to the switch to passives in the fixed income sector and the reality is that it is not always a good investment outcome for clients.”

Table to show I-Class Performance

Fixed income indices, unlike equity indices are weighted by market value rather than market capitalisation with the result that issuers with the most debt outstanding make up more of the index exposing investors to highly indebted companies and sectors such as the water industry, the group said.

It warned that investment grade passive fixed income funds are forced to sell firms which have been downgraded – so-called fallen angels – within a certain timeframe, locking in capital losses, while they may also exclude firms which are not investment grade and miss out on opportunities around fixed income ‘rising stars’ such as the takeover of Co-Op Bank by Coventry Building Society last year.

* Rathbones analysis of Investment Association and Morningstar data

Main image: omid-armin-6Aw1X7q1sbA-unsplash