While the Covid-19 pandemic has had a detrimental impact on dividend payments, the outlook is ‘brightening’ for income investors, research from the Association of Investment Companies has shown.

More than four fifths (87%) of income investors said they had been impacted, with more than a quarter (28%) reporting a ‘considerable’ or ‘big’ impact to their portfolios.

Almost half (45%) of income investors who have been impacted by dividend cuts are accepting a lower income for the time being, while 29% have made changes to their portfolio to address he loss of income.

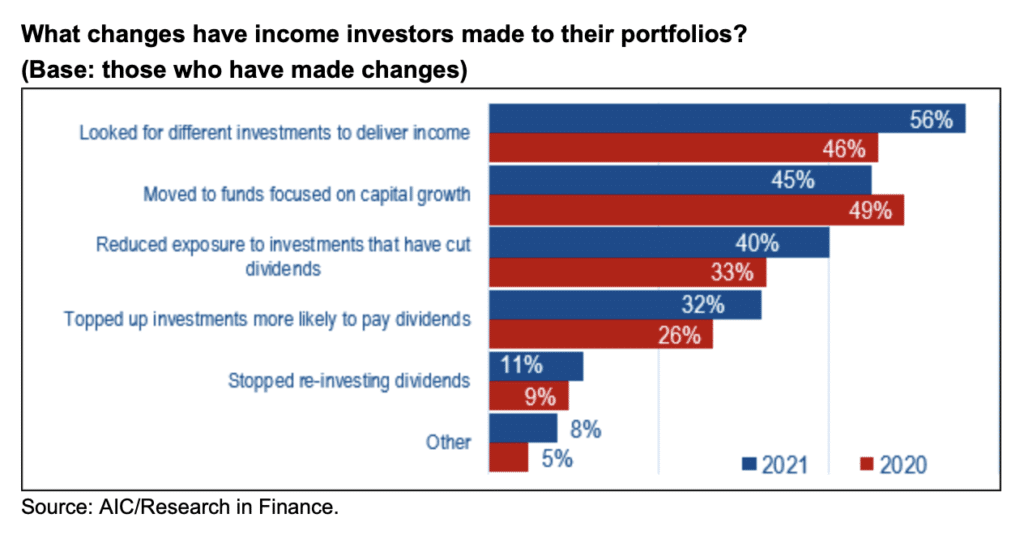

Of the 29% who have made changes to their portfolio, 56% of this group have looked for different income-producing investments such as investment companies or bonds and almost half (45%) have moved into growth investments, the AIC said.

However, fewer than one in ten (9%) income investors have had to rethink their future plans or lifestyle in response to dividend cuts, down from 17% last year. Of these, 41% have had to cut back on non-essential items or activities, down from 63% in 2020 and 16% have had to delay their retirement, down on the 19% who had to do the same in 2020.

The AIC said the 91% who haven’t had to change their plans or lifestyle were adopting a positive outlook. Nearly two fifths (40%) believe they won’t have to make changes even if businesses continue to pay lower dividends, and a further 30% said they could maintain the same lifestyle for three years before any changes would need to be made.

The AIC’ research also found that almost a fifth (19%) of income investors who do not currently use investment companies are considering investing in them in the next 12 months, with investors citing the reliability of dividends as the biggest driver. Meanwhile, existing investment company investors are also expecting to invest more in investment companies in 2022, with 38% planning to do so.

Annabel Brodie-Smith, communications director of the Association of Investment Companies said: “Although dividends haven’t fully recovered from the pandemic, it seems the outlook is brightening for income investors. Fewer investors are experiencing such a big impact on their portfolios and fewer are having to make hard choices to compensate for the loss of income.

“Unfortunately, some investors are still having to cut back on everyday luxuries, cancel holidays or even delay retirement, but most now feel they won’t have to change their lifestyle even if businesses continue to pay lower dividends.

“Investment companies’ income advantages have clearly been important for investors over the past year. Both investors who already invest in investment companies and those who don’t are expecting to invest more in investment companies over the next 12 months, with reliable dividends a key reason for doing so for both groups. Investment companies’ ability to use a revenue reserve, invest in a wider range of income-generating assets and use capital profits to top up dividends has helped investment companies deliver income when investors needed it most. It’s good to see more investors benefitting from these advantages.”