Philip Matthews, co-portfolio manager of the TB Wise Multi-Asset Income Fund, looks at the evidence

No area of business or financial markets has been left untouched by the global pandemic. While some sectors have thrived in an accelerating virtual world, others have seen stiff headwinds due to successive lockdowns. Economically sensitive sectors dependent on a normally functioning economy have been acutely vulnerable in these extraordinary times.

The impact on commercial property has been profound. Office staff have worked from home in their millions, while many commercial premises such as shops, pubs and restaurants have been shuttered due to unprecedented restrictions. Moreover, the pandemic has challenged the very existence of the traditional office working model. Commercial property managers have, therefore, had to navigate the twin storms of declining income and a shell-shocked UK economy.

As lockdown restrictions ease and consumers and office-workers are gradually allowed to return to previous patterns of life, it will be interesting to see whether the behavioural change enforced during lockdown endures or whether consumers revert back to spending money in physical stores and abandon the working from home experiment.

There have been clear casualties on the high street and the last twelve months have made it extremely challenging for landlords to collect rent from tenants, who have seen their revenue disappear. However, now consumers can redirect their excess savings built up over the course of the last year away from online businesses, we shall see whether the impact of lockdown is more cyclical in nature or whether it truly has accelerated the structural change that had been brewing long before Covid-19 struck.

Whereas many domestic cyclical sectors of the stock market have been quick to price in recovery and earnings forecasts already expect pre-Covid profits to be surpassed, the property sector remains at depressed levels, suggesting the market has made its mind up that property companies will be permanently impacted.

Indiscriminate sell-off of trusts

Despite entering the Covid crisis on depressed share prices following three years of uncertainty post the Brexit vote, the impact of Covid has seen the net asset values of many quoted property companies reduced by valuers in the face of material uncertainty over the sector’s outlook.

In many cases the discounts at which the shares trade compared to these net asset values have also widened. To illustrate this, we would highlight the performance of three holdings held within the TB Wise Multi-Asset Income Fund, namely the Standard Life Investment Property Income Fund, Ediston Property Investment Company, and Palace Capital.

These are well-managed companies with holdings across the Industrial, Retail Park and Regional Office property sectors. Since the end of 2019 they have on average seen asset values fall by 16% compared to pre-Covid levels, however, they have doubly suffered as the discounts to these values the shares trade on have increased from 12% to 25%.

Put another way, on average, investors are now being offered these companies at a 36% discount to the best estimate of their worth prior to Covid hitting.

It is encouraging, therefore, that the messages coming out of the companies themselves have become noticeably more upbeat in recent months even before we have fully enjoyed the freedom that the post-vaccine landscape should hopefully afford us. Standard Life Investment Property Income, for example, saw its net asset value per share increased by valuers at its latest December valuation whilst it also announced it had sold over 10% at its portfolio at a level in line with this valuation, increasing our confidence that these values are indeed reflective of transactions in the marketplace.

Dividends

The management teams of all three companies have taken a prudent approach to the payment of dividends. In the face of reduced rent collection and uncertainty around the timing and extent of lockdown measures, these companies have on average reduced their dividend payments by a third.

As Real Estate Investment Trusts (REITs), the boards are required to distribute at least 90% of property income within 12 months of the year end. We believe current dividends are well covered by earnings.

Ediston Property Investment Company has recently announced it will increase its dividend by 25% reflecting the strong rental cover of its dividend as retail parks have seen footfall hold up well during the crisis. Similarly, the Standard Life fund has brought forward the payment of its fourth interim dividend and now expects to pay a fifth interim dividend. Palace Capital has announced the quarterly minimum dividend level it will pay but has stated this will increase with greater clarity on the economic outlook.

Data sourced from company statements, as of 13 April 2021.

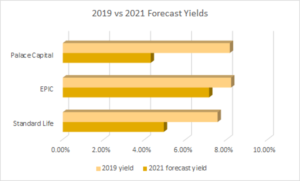

We believe the yield on offer within the sector looks attractive today. On average these three companies are forecast to yield 5.5%, however, we believe there remains significant scope for these dividend yields to increase as earnings recover with rent collection normalising. Were 2019 levels of dividend to be restored, these three companies would yield 8.0%.

The potential to grow dividends over 40% off an attractive base makes the sector stand out as one of the most attractive sources of return today, whilst offering significant, untapped exposure to recovery should the economy rebound as strongly as is forecasted.