How can advice firms incorporate clients’ responsible investment requirements into the advice they give? Steve Kenny, chief distribution officer, Square Mile Investment Consulting and Research, looks at the practicalities, the different investing terms potential regulation in the not too distant future.

Few adviser firms will be unaware of the significant sea change in investor sentiment over recent years due to the increasing number of clients seeking to conduct their lives in a way that can tackle challenges facing society or the environment and wanting their investments to mirror this aim. This is reflected in the rapid proliferation of funds that aim to help build a better world, whilst encouraging best corporate practice and policies at a societal or environmental level.

Few adviser firms will be unaware of the significant sea change in investor sentiment over recent years due to the increasing number of clients seeking to conduct their lives in a way that can tackle challenges facing society or the environment and wanting their investments to mirror this aim. This is reflected in the rapid proliferation of funds that aim to help build a better world, whilst encouraging best corporate practice and policies at a societal or environmental level.

This shift in investor mentality is not purely anecdotal. Square Mile conducted research in the first quarter of 2021 which found that 41.7% of advisers surveyed felt that over half of new clients will seek to invest in ESG, responsible or sustainable strategies within the next three years. If this is the case, any adviser firm which has not thought hard about how this appetite for such strategies can be met by their investment proposition is at risk of missing out on new business.

If this is not a sufficient carrot for adviser firms to consider incorporating Responsible Investment as part of their offering, it is expected the UK regulator will mandate this . Although the UK is no longer subject to the EU’s MiFID regulations, which require European advisers to ascertain and account for their clients’ sustainability preferences, the Treasury has opened a review of the EU’s ‘green regulations’ to consider how the UK can introduce a comparable regime. The timings and extent of this are yet to be confirmed, but advisers should already be preparing themselves for any new regulatory requirement to interpret their clients’ preferences in respect of Responsible investment.

Differentiating between terms

A fundamental first step is to address any confusion surrounding terminology. ‘ESG’ and ‘Responsible investment’ are often used interchangeably, but there is an important distinction between the two. ESG can be seen as a lens that a fund manager can use to determine the attraction of a stock and as a means of mitigating risk – a hygiene factor along similar lines to free cashflow analysis, for example. It gives an indication of how a company’s ESG credentials might act as a tail or a headwind to its future success.

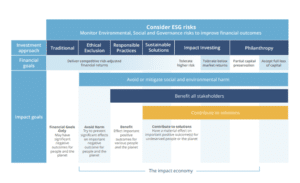

Responsible investment, on the other hand, is an umbrella term that the Investment Association is encouraging the industry to adopt to capture a spectrum of differing investment approaches, ranging from those that exclude certain securities or sectors to those that are focused on delivering a positive and measurable impact to society and/or the environment. This spectrum, also known as the Spectrum of Capital, as illustrated below, is increasingly being used by fund groups in their client communications as it helps to demonstrate where products sit within the broad range of Responsible investment strategies available and what clients can expect from them.

Most investors will identify with one or a combination of four broad categorisations:

- Ethical exclusions to avoid industries and company practices that cause harm to people or the planet.

- Responsible practices which consider the operational practices of investee companies, support ‘best practice’ in their respective industries, and encourage them to improve their environmental and social performance.

- Sustainable solutions which seek to invest in companies that provide solutions to social and environmental challenges and believe in the long-term financial benefits of doing so.

- Impact investing is where money is put to play in making a wider positive social or environmental impact with the additional requirement of evidencing this impact.

To determine where a client’s preferences lie, it is essential to have a frank and open conversation which cuts through the jargon associated with ESG and Responsible investment. As part of this, a consistent framework of terminology is a useful tool to help determine where on this Spectrum of Capital a client sits.

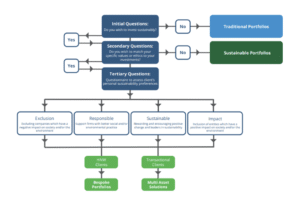

Given the widespread interest in extending social and environmental preferences to investments, one option would be to offer Responsible investment solutions as a default and have clients opt out of this stream if it is of no interest to them. This change may be too extensive or radical for some adviser firms and a more incremental approach may be preferred. However, the evolution of a fact find does not have to be complex and could be facilitated by the introduction of a few key questions to open a discussion. The following diagram provides an example of what this might look like in practice.

Depending on the results of this process, advisers can then assign their clients into one of three broad silos. Some clients will continue to have little or no interest in Responsible investment and for them, traditional portfolios will continue to be appropriate. Others, meanwhile, will be happy that their investments are broadly aligned to their aim of doing good and avoiding doing harm and will be satisfied with a diversified portfolio of funds which have a clear mandate to invest across the Responsible Investment spectrum. However, clients with specific value or ethics-based investment requirements will require greater consultation to determine the solutions that are best placed to meet their needs.

Whilst a Responsible Investment revolution is underway, advisers can take a more evolutionary approach to fine tuning their client communications. This brave new world of Responsible Investment is an excellent opportunity for advisers to demonstrate the value they can add to their client relationships by listening to their preferences in this respect and translating them into investment solutions that reflect them.

[Main image: nick-fewings-unsplash]