Gilts are back on the menu for investors as part of financial and tax planning, says Laith Khalaf, head of investment analysis at AJ Bell.

In the middle of a bull market in stocks, gilts are back on the menu for investors. They might not offer the eye-popping returns experienced by Nvidia shareholders, but nonetheless individual gilts were some of the most popular investments made over the last year on the AJ Bell platform, both by financial advisers and DIY investors. There are two powerful driving forces behind the resurgent demand for gilts: higher interest rates and tax considerations.

Clearly rising interest rates have precipitated gilt yields which are much more appealing. The benchmark ten year gilt is now yielding around 4%, compared to as low as 0.1% in the depths of the pandemic. The transition in monetary policy has been brutal for existing gilt holders who have seen the value of their bonds fall dramatically, but it has ushered in a new era where gilts should no longer be treated as a pariah asset class and can actually play a useful role in portfolio diversification.

“The tax treatment of gilts has also fuelled their popularity. Investors aren’t liable to capital gains tax on gilts, so if you can find a gilt where a lot of the yield is coming from capital returns rather than interest, you can save on your tax bill. This is where we have seen a lot of activity in the gilt market, with short-dated, low coupon gilts being effectively used as a tax-efficient cash alternative. This has led to big savings for higher rate and additional rate taxpayers, some of whom have picked up bonds where the equivalent taxable cash account would need to be paying interest of 7% or more to match the yield, after tax. There is likely to be some continued appetite for using gilts as tax-efficient, safe cash alternatives for a rainy day fund. Especially in light of frozen income tax bands. But gilts can be used for other purposes too.”

Using gilts to meet fixed financial goals

Individual gilts have a specific maturity date, and so can be useful for investors who have a financial goal which comes with a set time by which it needs to be achieved. An example might be investing for a university fund, or for a tax-free cash lump sum to be taken at retirement. In this way they act a little like fixed term cash accounts, except some of the returns from gilts may be tax-free because they are capital gains, not income. Gilts can also be sold before maturity and the cash returned to investors if they need it in an emergency, though the market price can be higher or lower than their initial investment. Fixed term cash accounts tend to be less flexible, prohibiting withdrawals before maturity, or requiring savers to forego some or all of the interest accrued if they require access.

Gilts are also available at longer maturities than fixed term cash accounts for those who have a more distant financial goal and want to lock in a set interest rate. The era of ultra-loose monetary policy meant that the government was able to issue gilts with extremely low coupons, which are still available across the maturity spectrum. These are helpful stepping stones for those who wish to reduce their tax bill by locking in capital gains rather than income, because they are investing outside a SIPP or an ISA (see table below). The longer dated the bond that you buy, the more volatile it can be expected to be though, and the more sensitive to interest rate movements. Cashing in early could therefore create a loss if interest rate expectations have moved up since your purchase. Longer dated bonds with low coupons also have lower prices, and so the actual income yielded per £100 of investment will tend to be higher.”

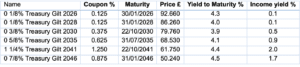

Examples of low coupon gilts at various maturities

Source: Refinitiv, 20 March 2024. Yield to maturity assumes income can be reinvested at that same yield, which may not be possible in practice.

Using gilts as an annuity alternative

“If you hold gilts in an ISA or SIPP and so aren’t too worried about the tax generated by the interest paid, you can use higher coupon gilts as a source of annual income. The returns here are coming mainly from income, plus potentially some capital appreciation, depending on the gilt in question. This strategy might be considered as part of an income strategy by those in retirement, in a SIPP Drawdown account or ISA, as it’s similar to what an insurance company does to provide you with an annuity income. The difference is the annuity company also takes control of your capital, which it pays back to you over time, hence why the annuity rate will be higher than gilt yields alone. It also pays out for your entire life, even if you live to over 120. A gilt held in a SIPP drawdown account wouldn’t necessarily do that, and so this approach could mean you run out of money before you die.

“However you have much greater flexibility over gilts held in a SIPP drawdown account or ISA rather than an annuity. You can hold gilts alongside equities and funds, to produce a diversified stream of income with the potential for capital and income growth. You can also dictate when the capital is run down, perhaps leaving it untouched to begin with if you don’t need the boost to your income immediately. This might be because you have enough in your pension to generate sufficient income without withdrawing capital, or because you’ve taken a tax-free lump sum which is covering your expenses, or perhaps you are phasing your way to full retirement and still have some employment income coming in.

“You can also dictate when the interest is withdrawn from the SIPP drawdown account so you minimise the tax payable. Any income withdrawn from an ISA is of course tax-free. By contrast an annuity is paid regularly like clockwork. That’s part of the appeal but there is no way to hold back payment in one year if you’re facing a large tax bill. Annuities are pretty valuable if you happen to live to a ripe old age, but not if you die young, in which case your pot disappears (unless you paid upfront for a spouse’s pension or a guarantee period). With gilts held as part of a SIPP Drawdown or ISA portfolio, if you die before the fund is extinguished, the remainder can be passed onto beneficiaries after tax.”

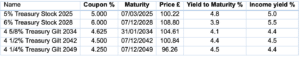

Examples of high coupon gilts at various maturities

Source: Refinitiv, 20 March 2024. Yield to maturity assumes income can be reinvested at that same yield, which may not be possible in practice.

Using gilts to diversify

“Gilts can of course also be used as diversifiers for an equity portfolio, and the lenient tax treatment can be helpful for those investing outside a SIPP or ISA wrapper in lieu of bond funds, which pay a taxable interest payment. Bond prices often move in the opposite direction to the stock market, so holding them in a portfolio can dampen volatility. It also means all your eggs aren’t in one asset class bucket. There was a huge cost to diversifying using gilts when interest rates were low, because yields were close to zero and investors had to accept below inflation returns from this side of their portfolio. As a result, many turned to other sources of diversification such as gold, property, infrastructure and absolute return funds. With yields back at more ‘normal’ levels, investors can now comfortably use gilts to hedge against stock market movements while picking up a reasonable return from these bonds.”

The outlook for gilts

“If you’re planning on holding gilts until maturity then the market outlook might not unduly concern you. Gilts come with the safety of knowing you will receive a pre-defined income and a capital sum on maturity, except in the extremely unlikely event the UK government defaults on its debt. Gilt prices fluctuate on the market though, so if you cash in before maturity, you could make a gain or a loss on your investment. You may even feel that by waiting to buy gilts, you might be able to pick up a higher yield further down the line. But as with stocks, there are competing forces which make it hard to forecast the precise direction of gilt prices and yields, so timing the market is a dangerous game.

“Looking at the current economic picture, gilts stand to benefit if there is a decline in interest rate expectations. It’s important to recognise that’s not necessarily a decline in interest rates themselves, as some cuts are already baked into pricing. But if inflation falls away quickly and perhaps dips well below 2%, or if the Bank of England starts sounding more dovish, we may see gilt prices rise, and yields fall. Likewise if there was a flight to safe haven assets prompted by some kind of economic shock, again gilts would be expected to rally. Tactical investors would then have the opportunity to cash in their chips at a profit and reinvest elsewhere if they didn’t want to wait for the maturity payout.

“But gilt pricing is a two way street. If an economic shock took the form of another bout of inflation, gilts would likely sell off, as markets revised their forecasts for future interest rate policy. The supply of gilts coming to the market is also looking pretty punchy, with the Bank of England selling down the holdings it acquired through Quantitative Easing at the same time the government is still issuing lots of new debt to fund the deficit. This means the private sector is going to have to absorb relatively high levels of government debt for some time to come, around 6.3% of GDP per annum over the next five years. That compares to an average of just 2.7% of GDP per annum from 2000 to 2023.

“We have of course had high levels of government borrowing before, in particular after the financial crisis and during the pandemic. But back then the Bank of England was gobbling up gilts as part of its QE programme. Now that’s gone into reverse and the Bank is selling down its holdings, which means more supply having to be absorbed by buyers. So far this year gilt auctions have generally been three times oversubscribed, so there is clearly a lot of demand out there. How this nets off against a high level of supply in coming years remains to be seen. The reassuring thing about gilts is you can always wait until maturity for the bond to be redeemed, so provided you are comfortable with the yield on offer at outset, there’s a safety net in play.”