The Retirement Living Standards are a fantastic introduction to income needs in retirement, especially for non-advised clients, but can these be used for advised clients and what can paraplanners do to help? Royal London’s Senior Intermediary Development and Technical Manager, Craig Muir, looks at the figures.

In October 2021, the Pensions and Lifetime Savings Association (PLSA) announced their new Retirement Living Standards. They created these living standards to help people picture what kind of lifestyle they could have in retirement.

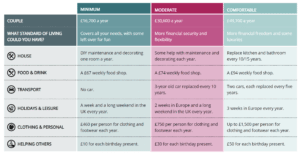

The standards show what life in retirement looks like at three different levels: Minimum, Moderate and Comfortable living – which you can see along the top of the table shown, and what a range of common goods and services would cost for each level which you can see underneath.

They’ve further split this down in to values for singles and couples, and for living in or outside London. What you’re looking at here are the figures for couples who live outside London.

*These amounts would fund this lifestyle for people living outside London. See The Detail for more information.

Source: Pension and Lifetime Savings Association, October 2021.

Now this is of course a very rough average and you, as a paraplanner and your adviser associate, would be looking at your client’s individual needs and objectives. But perhaps you could suggest they’re used at an initial client meeting or, if there are employers on the books, they may like a presentation to their employees. The Retirement Living Standards could be used as an introduction to income needs in retirement. These could be used, for example, to explain that an average couple outside of London looking for a comfortable retirement would need an income of roughly £49,700. This would allow them to make alterations to their house every 10/15 years, have £94 per week for food, run two cars and replace them every 5 years etc.

We know many people don’t know how much income they need in retirement and only have a vague sense of what they should be targeting. So why not also add the Retirement Living Standards to your company website? These would give potential clients an idea of how much income they should be targeting.

And although this is a great starting point, what they don’t do is tell potential clients how they can achieve these targets, which is where you come in to help provide a targeted plan to achieve their needs and objectives.

The power of these Retirement Living Standards lies in giving people a real sense of what they will be doing and how they could be spending their money when they finish work. They explain to clients about the building blocks of their lives – their car, their home comforts, how much they can give their family, the kind of holidays they’ll have, and it helps them visualise what they want in their retirement and should help getting them to engage with their pension.

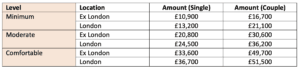

For a complete list of all the retirement living standards for both singles and couples, living inside or outside London, we’ve provided them in the following table.

There’s quite a difference between the minimum and moderate levels. A single consumer outside London with a moderate retirement living standard would need 91% more than the minimum level (£20,800 compared to £10,900). But the difference between comfortable and moderate is 62% (£36,700 compared to £20,800). This just highlights how much is required for basic income needs rather than additional discretionary spending. Thankfully for many, their basic income needs will mostly be met if they receive the full new state pension which in 2022/23 is £9,627.80.

Checking the state pension forecast service on the government website will explain how much they’ll receive, and perhaps if they know the minimum retirement living standards will be met, it may encourage them to target a higher income and save more into their pension.

[Main image: aphael-wild-yCHF-MGxvG4-unsplash]