Paul Craig, portfolio manager at Quilter Investors:

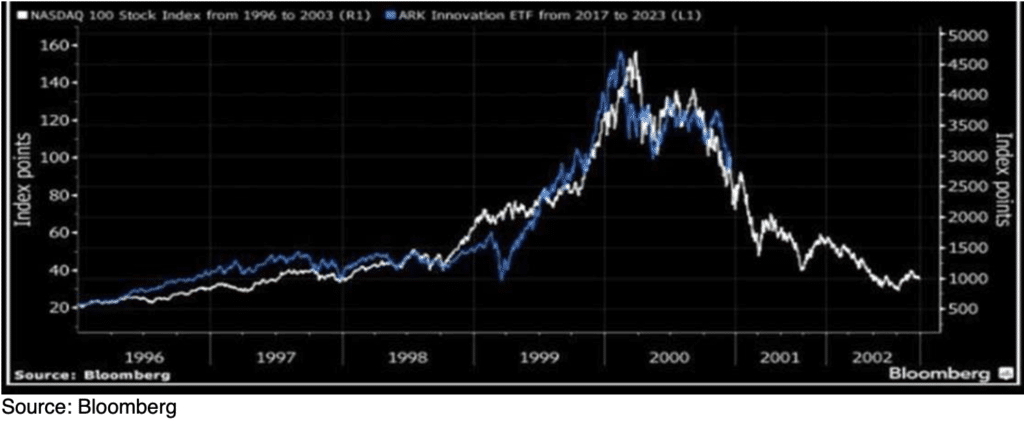

Much has been made of the rise and rise of the tech stocks in recent years and how closely it mirrors the tech bubble of the early 2000s. However, it appears that today’s bubble may finally be bursting, for some at least. Using an ETF with heavy exposure to ‘high-growth’ tech companies as a proxy, the path its stock price is charting is eerily similar to that of the Nasdaq 100 index 20 years ago.

The chart below is a timely reminder that financial markets are not just a collection of spreadsheets and calculus, but a collection of people and their opinions. We are potentially witnessing the end of the valuation bubble in emerging start-ups, hyper-growth and companies wearing tech clothing, and it would not be a shock to see more pain going into 2022. Returns are going to be harder to come by and with support from central banks being scaled back, extreme growth oriented stocks may struggle in an environment we have not operated in for well over a decade.

This is not to say that investors must shun all technology stocks. There are some good companies out there that are taking advantage of long-term structural changes. At one extreme are the mega-cap tech companies that have already gained significant market share and generated huge piles of cash. And at the other extreme are emerging start-ups through venture capital – high-risk, high-reward (hopefully).

Perhaps somewhat overlooked, by comparison, are quality small and mid-cap companies, typically global leaders in their niches with attractive economics and high levels of research and development and intellectual property.

Investors will also need to take care not to anchor one side of their thesis but not the other. For example, the increasing use of artificial intelligence and automation means there will of course be a role for technology companies, but investors will need to constantly reassess their expectations on the opportunity set, and the price they are willing (or having) to pay for that business, especially against a backdrop of a more hawkish Federal Reserve.

For investors there should be plenty of opportunities in the middle ground of companies. This strategy should ensure that you don’t get sucked into the speculative share prices or extreme swings in volatility, while also not becoming overexposed, or reliant, on the tech stalwarts of yesteryear.

NASDAQ 100 – 1996-2003 vs ARK Innovation ETF 2017-2021