Investment can deliver greater value for all stakeholders if it takes all stakeholders into account, argued Matt Evans, portfolio manager, Ninety One, at the recent Professional Paraplanner Investment Committee Seminar. Rob Kingsbury reports.

“We genuinely believe there is a fundamental shift occurring,” Evans said “It is now possible to set up investment strategies with sustainability central to the approach, without giving up the core reason for investment, which is to generate financial returns.

“We have a strong belief that if you can consider deep sustainability criteria within all your investments, that sets you up to find good compelling opportunities. But you must invest with conviction in companies that can deliver those financial returns over time, having assessed material risks as well as those areas of real opportunity.

Consumer views, regulation and employees all affect how companies now must operate, he explained. “In addition, corporates now require societal licence to operate, because consumers care a lot more than in the past about the companies they buy from and how they are acting.

“There is a real risk now to businesses who don’t understand that.”

ESG Ratings

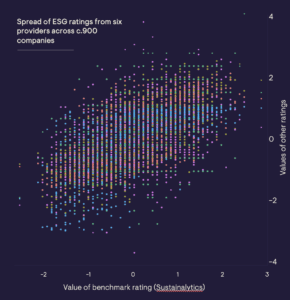

A major area of concern for the team, Evans said, is the lack of consistent and therefore, reliable data in the market.

“The ratings agencies can play a role but they are backward looking and there are huge inconsistencies in how they assess the data.”

Evans demonstrated this with a scatter chart showing the spread of some 900 companies as rated by six agencies.

“It’s a difficult area. Our view is that you have to take a bottom up, fundamental approach to researching companies. This is something we have developed at Ninety One.”

Evans runs the UK Sustainable Equity Fund, which has three pillars of sustainability, he explained.

Pillar one is Financial stability. “This is going to be fundamental to all funds in the market, which is producing returns for investors. But where we think we differentiate is in Pillars 2 and 3. These are Internal Sustainability and Positive Impact.”

Under the Internal sustainability pillar, the team looks deeply into whether a company is run sustainably and considers the interests of all key stakeholders, as well as whether, for example, they make the most efficient use of all their resources.

“Consider a manufacturing firm,” Evans said. “Key questions to be asked are: How do they treat their employees? Do they have health and safety processes? How do they use their resources and materials, do they have a recycling process? Do they optimise everything they do?

“Sustainability can be used to effect margins and increase a company’s pricing power as well as having environmental benefits.”

Under the third pillar, the team analyses whether a company’s products and services can have a positive impact on the world around them. “We look to understand them and then measure how they have that positive impact.”

New toolkit

Ninety One has developed a new toolkit to help portfolio managers and analysts undertake deep fundamental bottom-up analysis, which combines quantitative and qualitative approaches to evaluate risk and impact in the context of growth and returns.

There are three key areas to this: Natural capital; social capital; and human capital.

“Using this framework we consider the risks in all business areas, whether in developed economies or emerging markets,” Evans explained.

“Natural capital includes carbon emissions analysis and biodiversity dependency, for example, and is easier to measure. But it is much more difficult to measure human and social capital.

“What matters in human capital is taking an active approach and engaging with companies, understanding how they are thinking,” Evans said. “It’s important to get out to the companies and asking the people on the floor if they understand the corporate culture, what’s expected of them, because it does matter and it can lead to a more successful business by having an engaged workforce that contributes to the strategic objectives of the business.”

Social capital, he explained, is how this all plays together from the people who work for those businesses through to all the other stakeholders, from government to consumer and the company’s supply chain.

“By having this framework we believe we can really get under the hood of those companies and spot the opportunities. It enables us to understand what they are doing today, and how that will put them in a more favourable position to deal with some of the risks they might face in a changing world.

“Today’s leaders in sustainability are not obvious. Investors need to be forward thinking and look at whether these companies will manage the risks better than their peers and achieve better financial performance as a result. Innovation and new tools are crucial for understanding and investing in the long-term sustainability leaders.”