Fund costs have become a top priority for advisers and their clients when assessing which funds to choose, new research from Aegon has revealed.

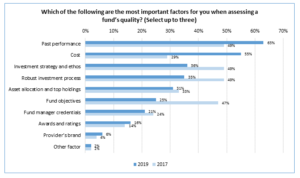

In a survey of 250 advisers, over half (55%) ranked cost as one of the top three most important factors. That figure has nearly doubled since 2017, when just 29% of advisers deemed cost one of their top considerations.

Nick Dixon, investment director, Aegon, said: “Fund costs are clearly front and centre in advisers’ minds and this reflects a number of trends, including the growing use of passive funds, regulatory pressure on fund managers to justify costs and consumer demand for low-cost investments.

“Prioritising cost doesn’t necessarily mean choosing the cheapest fund available, but it does mean that where a fund comes with an additional cost there is an assessment made that this cost brings with it the prospect of benefit to a level that justifies any additional fee. Such benefits might include the potential to improve investment growth or reduce volatility or might mean that ethical considerations are met.”

The research found that past performance continued to rank as the most important factor for advisers, with 63% of advisers citing it, up from 49% in 2017.

In contrast, factors such as fund objectives (25%), robust investment process (35%) and investment strategy (36%) have all decreased in importance over the last two years.

Dixon continued: “Past performance has strengthened its position as the most important consideration when assessing funds and it’s understandable that advisers wish to see a strategy can deliver on its objectives.

“One implication of the focus on past performance is that the market may be slow to respond to change or the advent of new approaches. Advisers who focus on past performance should also be aware of any changes to a fund’s process, structure or management. Market conditions can also have an impact – a fund that has done well in the protracted bull market of recent years might struggle were market conditions to falter.”