7IM and AJ Bell have announced they are cutting VAT from their model portfolio ranges.

This, they say, will give advisers and their clients a cost-effective way to build a diversified portfolio.

For 7IM, the changes mean the 7IM Active and Passive model portfolios will have an all-in cost of 0.25% going forward, while the Bespoke model portfolios range between 0.25%-0.30%. The 7IM Pathway model portfolio range remains at an ultra-low total cost of 0.15%.

7IM’s model portfolios aim to give advisers and their clients a range of ready-made diversified multi asset investment solutions to suit a wide variety of risk and investment parameters.

At the heart of the model portfolios is 7IM’s three stage investment process: Strategic Asset Allocation to set the long-term plan, Tactical Asset Allocation to find opportunities to enhance returns*, and Robust Risk Management.

The price changes will come into effect as of 1 February 2021 and apply to the model portfolios available to advisers through the 7IM platform as well as third party platforms.

Verona Kenny, managing director on Intermediary said: “The removal of VAT will make our already competitively priced model portfolio service even more compelling for advisers, and importantly will provide a direct benefit to end clients.

“Despite challenging conditions, we have continued to innovate and enhance our proposition to respond to the needs of advisers and their clients. Over the past 12 months, this has led us to reduce the charges on our Sustainable Balance Fund, launch the 7IM Pathway Funds and deploy various platform upgrades which has resulted in record monthly flows onto our platform over 2020.

AJ Bell has removed VAT from its Managed Portfolio Service (MPS), reducing the annual management charge from 0.18% to 0.15%. The change brought the total cost of all AJ Bell’s passive MPS options below 0.50%, inclusive of the MPS ongoing charges figure (OCF) and core platform fee of up to 0.20%.

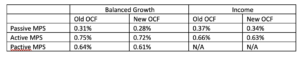

The impact of the removal of VAT on the OCF of AJ Bell’s Balanced Growth MPS and Income MPS options

The AJ Bell Investcentre core annual platform charge for SIPP, ISA and General Investment Account remain 0.20%, reducing on assets over £1m.

The annual charge for the AJ Bell Retirement Investment Account remain 0.25% on assets below £500,000 and 0.20% on assets above £500,000.

AJ Bell is also preparing to launch a Responsible MPS over the coming months, which will give advisers a low-cost managed portfolio for clients who want diversified exposure to companies with strong environmental, social and governance (ESG) credentials.

Kevin Doran, chief investment officer at AJ Bell, said: “These changes take all our Passive Growth MPS options below the 0.30% mark which means with our platform charge of 0.20% for our SIPP, ISA or General Investment Account, advisers now have access to a suite of risk-managed portfolios, on platform, at less than 0.50% per annum. That’s exceptional value in a highly competitive market, consistent with our commitment on costs.

“We are always looking at how we can evolve the MPS in line with the needs of advisers and are working towards launching a responsible investment option within the MPS over the coming months.”