Fidelity International has launched the Fidelity Global Future Leaders Fund, focussed on developed market small and mid-cap equities which have been identified as ‘Future Leaders’.

The stocks will typically be in the early stages of growth underpinned by a structural shift, technology-led disruption or changing consumer behaviour.

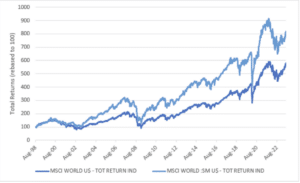

Fidelity said over the past 25 years or so, taken as a market segment, global mid-caps and small-caps have generated higher returns than large-caps (see Figure 1), and looking ahead, it expected new leaders will continue to emerge from the mid-cap segment – in part due to the difficulties incumbents face in staying ahead of the curve.

Figure 1. Long-term total returns profile comparison (US$)

Source: Refinitiv DataStream, 31 August 2023. US$ total returns indices – MSCI World and MSCI World Mid Small Cap Index.

Portfolio Managers James Abela and Maroun Younes, will aim to construct a diversified and balanced portfolio that delivers more consistent returns through different market cycles. The portfolio will hold 40-70 listed global small to mid-caps that are a blend of ‘quality’ (c. 40%), ‘value’ (c. 30%), ‘transition’ (c. 20%) and ‘momentum’ (c. 10%) companies3. A minimum of 50% of the Fund’s assets are invested in securities deemed to maintain sustainable characteristics4.

James Abela said: “There’s so much more to global investing than the mega household names such as Apple and Amazon that everyone is familiar with, and perhaps already own. There is a whole world out there and so many diverse opportunities, which are often under-researched. Yet therein lies the opportunity, since the relative lack of research on mid-caps and small-caps increases the likelihood that high-quality businesses with tremendous growth potential are flying under the radar and trading at attractive valuations.”