The increase in demand and pressure from both the ‘top-down and bottom-up’ suggest that the momentum behind responsible investing is here to stay, says Jack Dominy, senior research consultant, Research in Finance.

With the number of new fund launches over the past couple of years, the wealth of information available in the press and investment manager literature, as well as the acute focus on health and social factors as a result of the Covid-19 pandemic, it is fair to say that responsible investing has been a hot topic recently. Even the volume of phrases and terminology seems to intensify on a weekly basis, with new themes and areas of importance coming to light across the investment universe.

But what does the future hold for responsible investing? Will the demand for ESG-aligned funds and information be sustained? At Research in Finance, we believe the pressure exerted on retail intermediaries and institutional investors from both regulation at the top and greater awareness and understanding from the public at the bottom of the investment chain will ensure that the ‘snowball effect’ behind responsible investing will continue to grow.

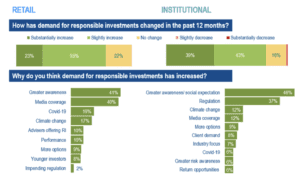

As shown by findings taken from Research in Finance’s latest UK Responsible Investing Study, both retail and institutional investors cite a surge in demand for responsible investments over the past 12 months (Q1 2020 to Q1 2021). This is in itself not eyebrow-raising – the drivers behind this demand, however, do pique interest.

Clearly the pandemic has brought certain social issues into sharp focus when it comes to how money can be invested to make a difference, but public figureheads and celebrities such as David Attenborough and Greta Thunberg have ensured the topics of climate change, deforestation and the health of the oceans are now ever-present in the mainstream news. ‘Greater awareness’ is given as the main reason for an increase in demand among retail intermediaries.

Greater awareness of ESG factors or responsible investing more broadly, as well as further media coverage through the press and documentaries, will likely breed heightened social expectation of companies to act more responsibly and asset managers to invest more responsibly. And some asset managers are recognising the positive influence they can have towards promoting sustainability when partnering with a well-known public figure. Such an example are EdenTree, who have launched an initiative with Team GB Olympic hopeful Alice Dearing, with the aim of increasing diversity in swimming. Partnerships like this have the benefits of reaching a wider audience, but also crucially offer a tangible example of how asset managers can invest for good, for a purpose. This is turn will help end investors understand the investment possibilities, how certain factors or themes can be targeted, therefore adding weight to the responsible investment ‘snowball’.

On the institutional side, pressure for local government pensions schemes to decarbonize and align themselves with the social goals of local councils is growing. This is greater awareness, but in a different guise – there is an expectation of pension schemes to act more responsibly, which is over and above an increase in demand for responsible investment solutions.

Greater awareness and increased demand from investors/members are not the only factors adding to the momentum, however. Regulation and legislation are also driving change, particularly among institutional investors. The recent introduction of plans to ensure pension schemes are required to report on their assets’ climate risks in-line with recommendations from the Task Force on Climate-related Financial Disclosures (TCFD), and make reporting accessible to members, has ensured a structural shift in how schemes need to think when it comes to responsible investing.

It is therefore not surprising that ‘regulation’ was given as the second most important driver behind the increased demand for responsible investments among institutional investors as part of the research findings. And whilst regulation does not register as highly on the retail side, the new Sustainable Finance Disclosure Regulation (SFDR) requirements in the EU may well be paving the way for future top-down pressure on asset managers for their UK investments.

Responsible investing is undoubtedly here to stay for the future. What is yet to be determined is how it will evolve given the influence from both public demand and regulation. Both awareness and understanding of the important ESG issues from end investors are improving, which are the keys to unlocking other responsible investing barriers. Understanding and improved knowledge can prompt an investor to speak about the subject confidently with their adviser and ask questions of them, which in turn will ensure advisers top up their knowledge and ensure they are able to offer the right solutions for their clients. The same is true on the institutional side, in terms of members demanding greater transparency of pension scheme investment. Professional investors must be prepared for the increased scrutiny and pressure, from all angles, as the snowball gathers momentum.